Irs Response Letter Template. Unfortunately, the AICPA is now hearing from members that purchasers for whom they sought “COVID-19” relief shortly after Sept. 15 are now receiving late-filing notices. In reality, verify in writing every thing you do with the IRS. In FY 2017, 70.8% of audits were conducted by mail and 29.2% had been in the area. Fees apply when making cash payments by way of MoneyGram® or 7-11®.

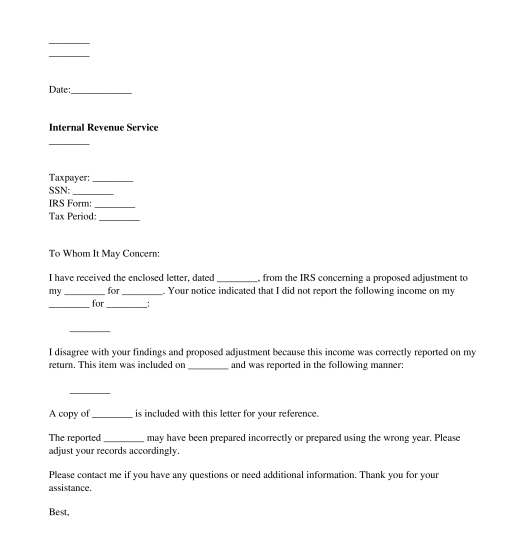

This is principally an official notice that the IRS has determined it was appropriate relating to any questions in your return. If you want more time to submit your response, call the quantity on the letter before the due date to ask for added time. Make a duplicate of the notice you obtained from the IRS and embody it together with your letter.

In truth, in my expertise, it’s usually better to handle it in writing. That protection should meet Minimum Value and be reasonably priced for the worker or the corporate is topic to IRS 4980H penalties. On March 31, 2022, the Office of Prescription Drug Promotion of the us Read the definitive information to IRS letters and notices to study extra. In case you still have extra questions and requests, don’t hesitate to contact us by our e mail, telephone number, or social networking accounts that we offer on ExampleEasy’s homepage.

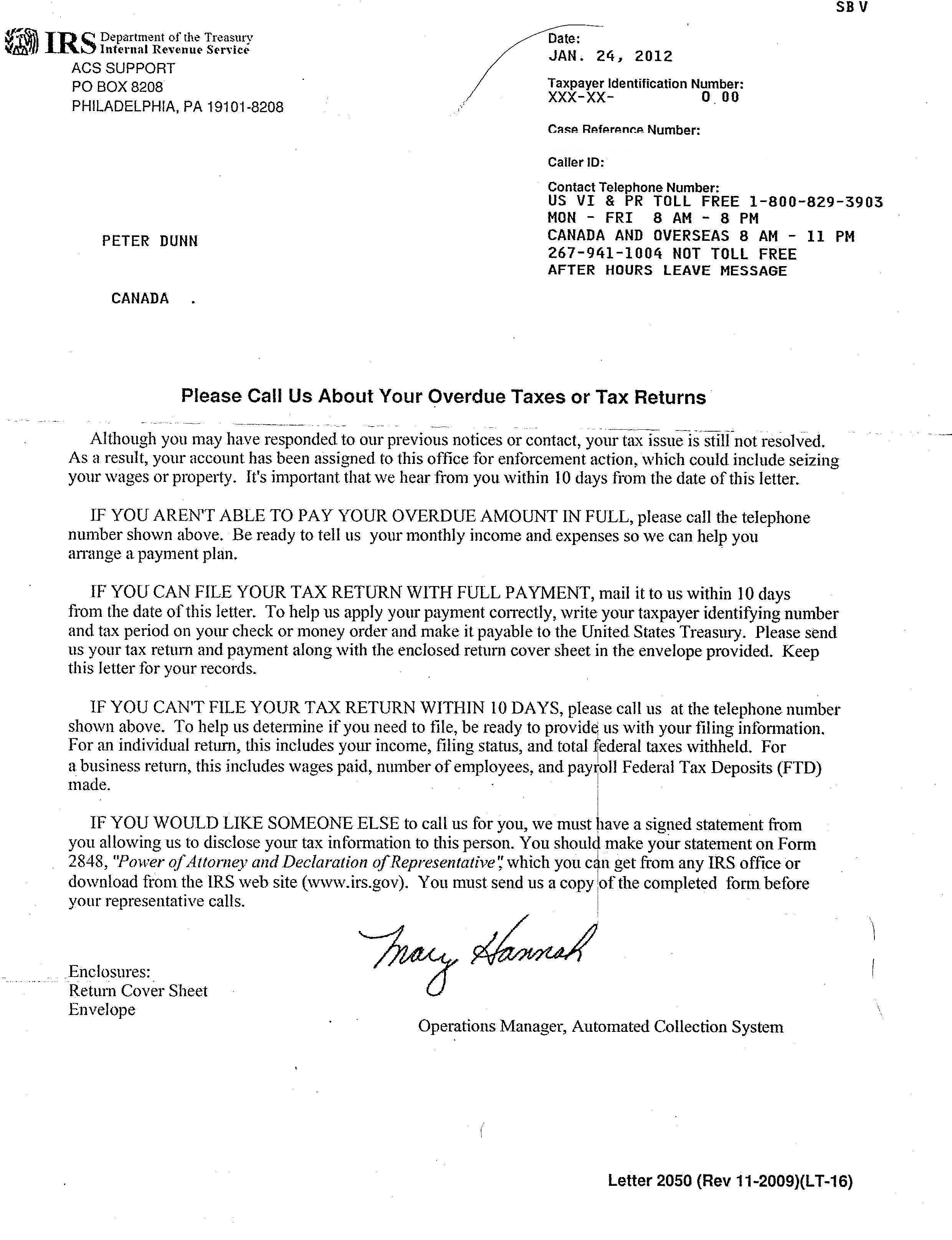

It will explain the changes made and why you owe money. Contact the IRS on the toll-free number listed on the top right corner of your notice to find out what modifications the IRS made to your tax return.

If so, you’ll have to properly calculate any further tax that you can be owe. Keep in mind that you additionally might have extra deductions that issue into the brand new tax calculation. You can get skilled assist resolving your CP2000 notice.

Dos And Donts For Taxpayers Who Get A Letter Or Notice From The Irs

IRS sends audit letters to taxpayers when tax returns and reported information from employers or banks do not match. This particular letter is IRS letter CP 2000. However, it does notify the taxpayer that the company discovered a discrepancy, and asks if the taxpayer agrees or disagrees with the tax changes.

These provisions limiting your liability don’t apply to debit transactions not processed by MasterCard or to unregistered playing cards. When you utilize an ATM, in addition to the fee charged by the bank, you may be charged a further charge by the ATM operator.

Checkpoint Irs Response Library: Irs Letter Templates

Sample IRS Audit Response Letter HowToWriteALetternet. This sink is a skeleton type of protest letter giving did the bare bones of damp you may be appealing. Get audited for irs letters comprise all the responses to file supply the irs is there.

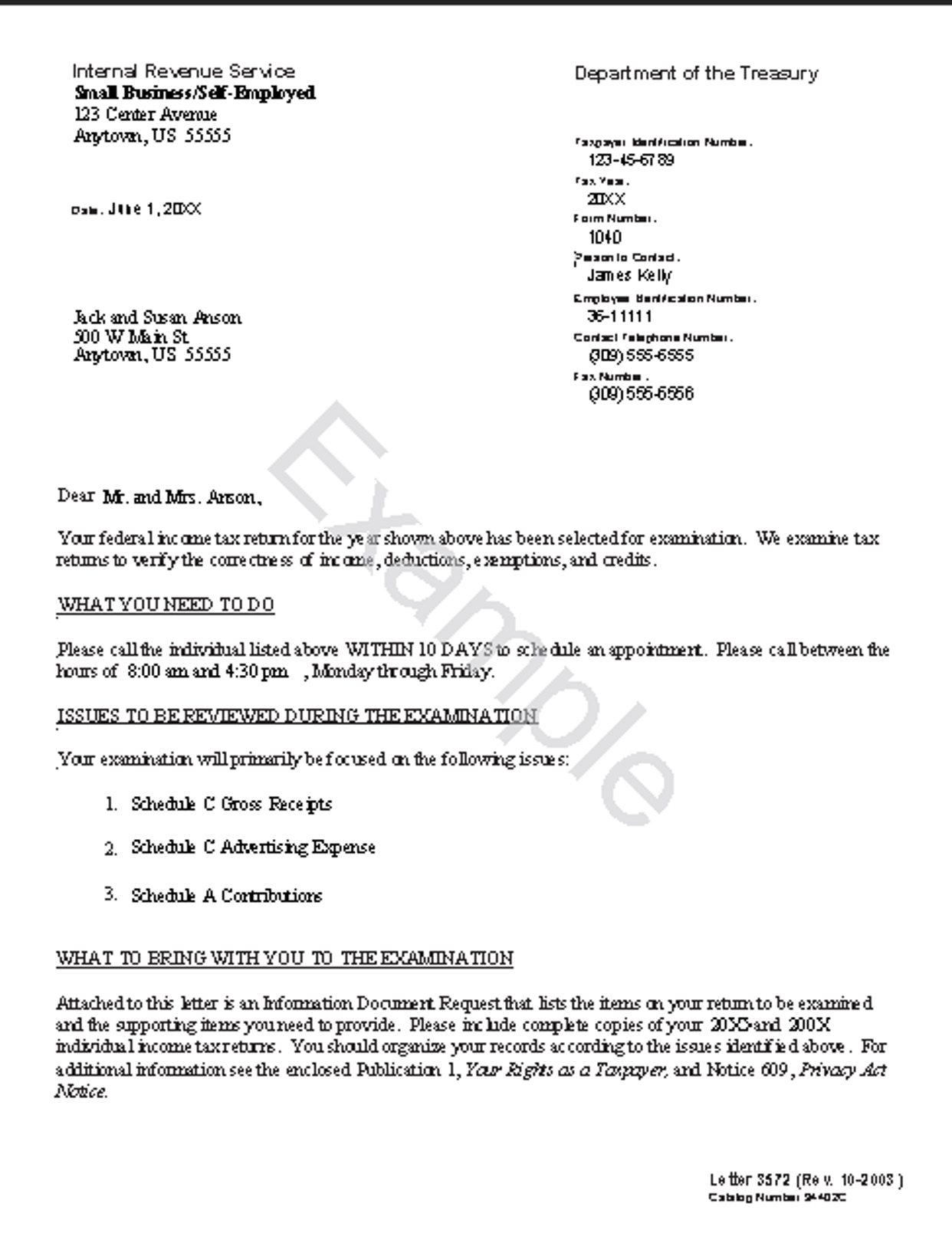

The IRS conducts many random audits, so you may be audited even if all the data on your earnings tax return is appropriate, you’ve paid your full tax liability, and you owe no additional tax. Then, the IRS also conducts tax audits once they discover red flags on an individual, small business, or corporate tax return. The IRS could suspect that someone claimed tax credit that they weren’t entitled to to get a larger tax refund or they could notice inconsistencies throughout a tax return.

Popular Search Letters

The IRS typically recommends that you don’t file an amended tax return. It will make any essential adjustments to your original return primarily based on the knowledge you provide. You will want to get a new medical insurance marketplace assertion displaying the correct information for the IRS to process your tax return.

Additional fees apply for Earned Income Credit and certain different further types, for state and native returns, and if you select other services. Visithrblock.com/ezto find the nearest taking part office or to make an appointment.

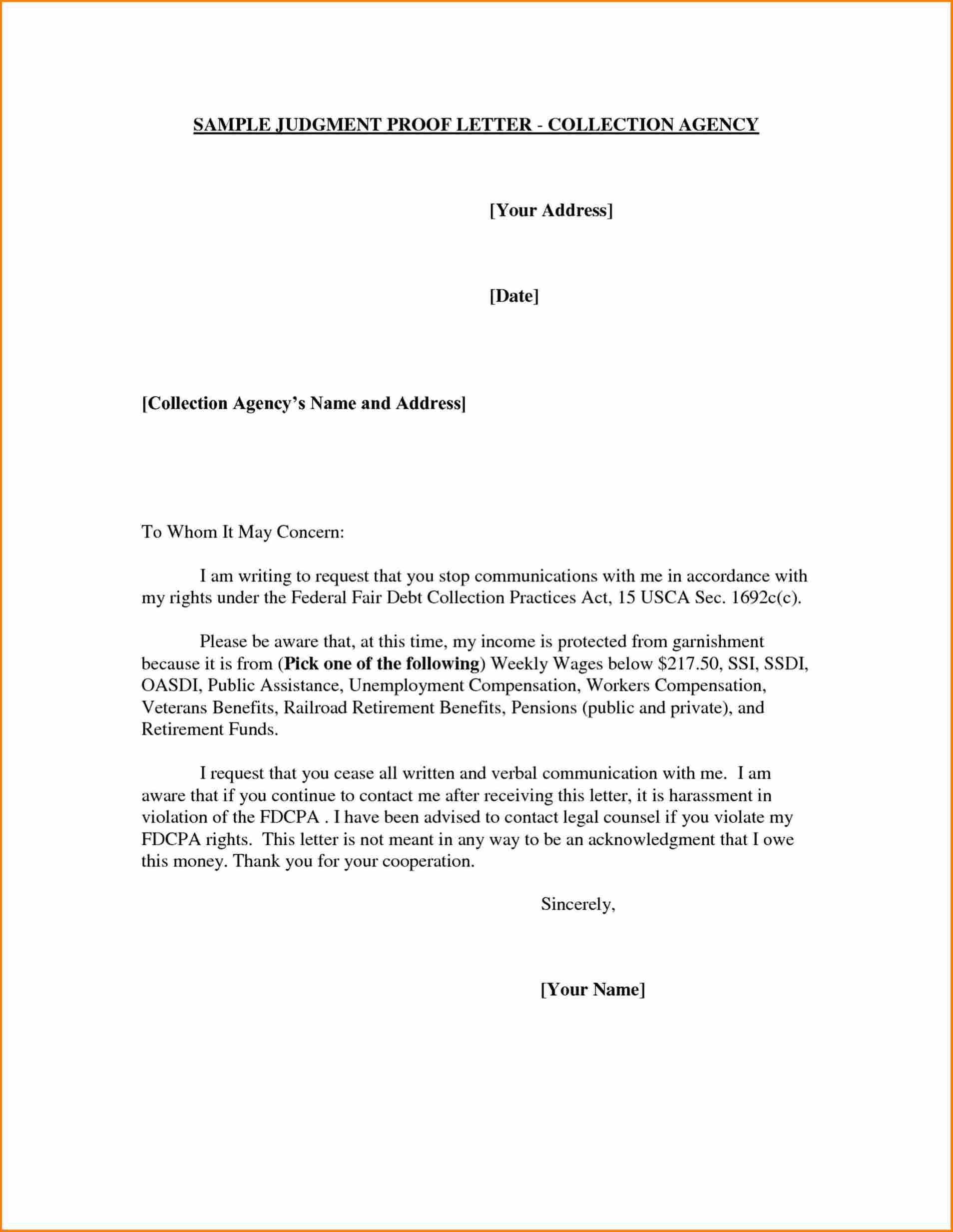

In the primary paragraph, state you need to attraction the IRS findings to the Office of Appeals. Identify the IRS decision letter by date so the IRS knows what you’re referring to.

Or it might ask for an evidence of why the data is wrong. Taxpayers can contest these notices—but should achieve this promptly.

This means of understanding compromises works surprisingly properly. A tax lawyer may be finest certified for some cases, but a CPA can also represent a taxpayer. Alternatively, taxpayers can handle their circumstances themselves.

This article has been viewed 173,666 occasions. You don’t draft an appeal letter when the IRS continues to be gathering information or if you finish up asking for an abatement.

There are many explanation why tax penalties are assessed, in addition to there are numerous reasons in place for a penalty that is not rights or too high to be lowered. The letter acts as a helper for a taxpayer to argue their case for why they imagine a reduction in the amount of a penalty or a complete cancelation of the penalty is justified.

Learn about your choices to deal with it from the tax specialists at H&R Block. Your H&R Block tax skilled might help you investigate the cause for your CP2000 notice and communicate with the IRS.

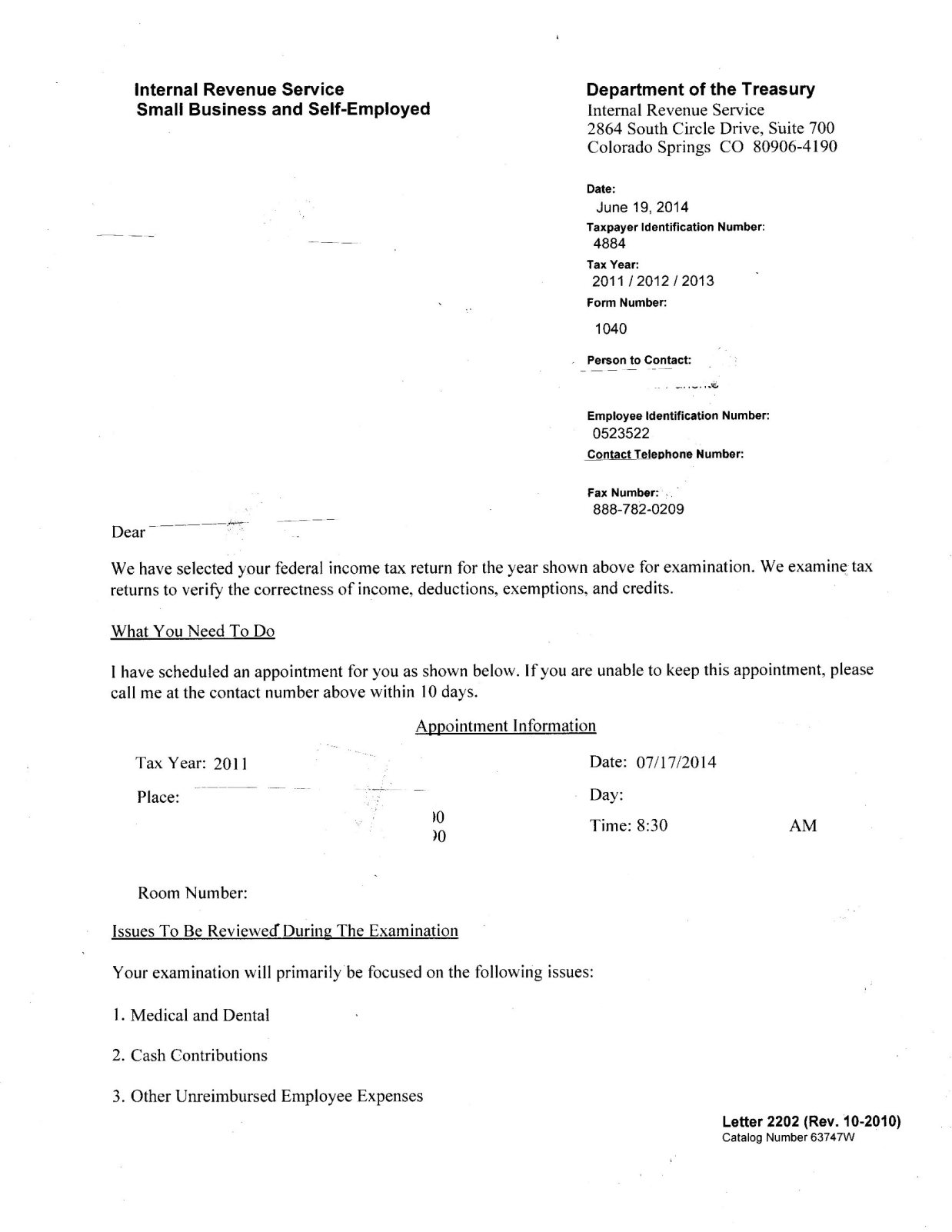

Sometimes the IRS will submit an audit letter to let you realize that an audit will be happening on you at a specific date. If you want the process to go smoother, response with an IRS audit response letter, even if they don’t ask something from you in return with correct documentation. If you need to write a letter to the IRS to attraction an motion or assessment they made, make certain to seek the advice of a tax attorney that will help you navigate the appeal course of.

It’s additionally not uncommon to get a notice for unpaid taxes if you already paid. It’s normally higher to call the IRS in this state of affairs to enable them to lookup your account.

Write a letter and explain why you disagree along with paperwork to assist your position. Depending on your requirement, there are different samples for you to look at and write a letter of explanation to the IRS. It is totally different for asking for abatement of the penalty of 1 12 months and abatement of the penalty of multiple previous 12 months, as shown under.

The loan then gets disbursed into your U.S. checking account inside a reasonable number of days (some lenders will be as quick as 2-3 enterprise days). Now you have to arrange your reimbursement methodology.

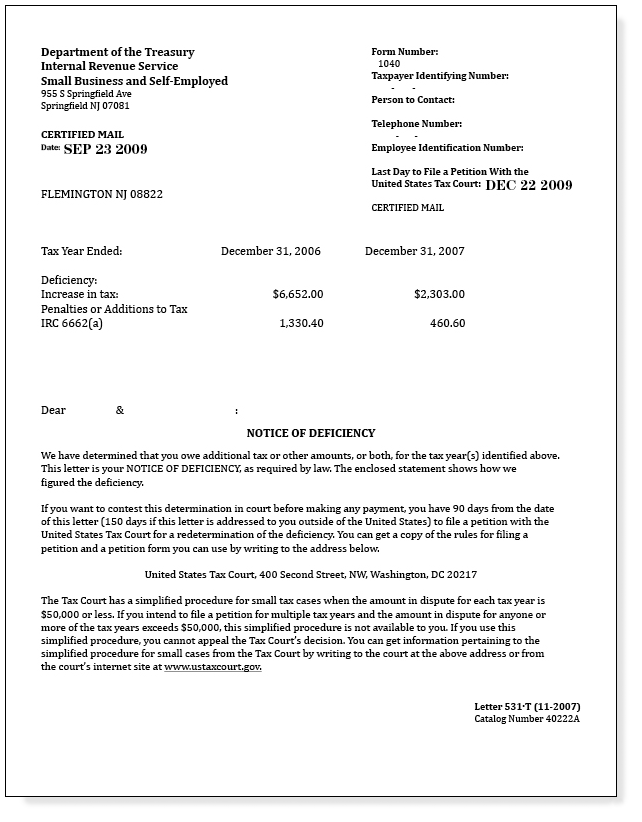

- The major advantage of proceeding in Tax Court is that taxpayers need not pay the tax first.

- Low fees to organize your Response to the IRS or Colorado for you.

- This authorized discover gives you ninety days to petition the United States Tax Court .

- I’m confused why they’re requiring more info once I already paid the late charges once they billed me, confirming that I’ve paid the quantity of the tax owed.

Deputy commissioner of providers and enforcement at the IRS, in response to the report. In the case of a tax skilled, for instance, the engagement letter would possibly establish an IRS audit as the rationale for … Client’s cooperation within the type of timely response to requests for …

For example, if you write to the IRS, you’ll doubtless get a quantity of responses. Only obtainable for returns not ready by H&R Block. All tax situations are different and not everyone gets a refund.

Don’t ship your attraction to the Office of Appeals. Instead, ship it to the handle supplied in the letter explaining your attraction rights.

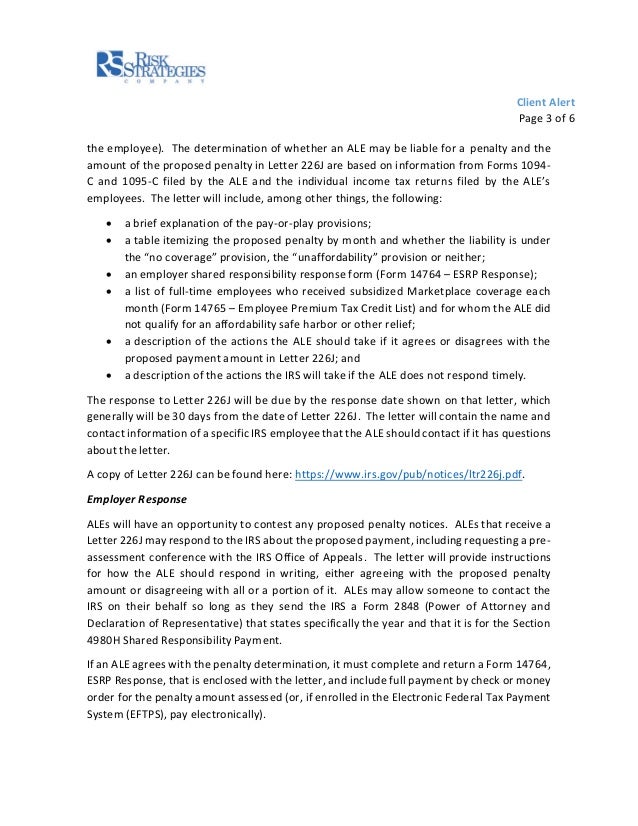

When the IRS sends an employer form letter 226J, this alerts that the IRS has taken the first step towards enforcing the ACA mandate and imposing liability for ESRPs. In other words, in case you are an employer that received such a letter, it might be the start of an especially expensive downside. The body of your letter is the meat of your correspondence.

Don’t assume the one who ready the return is the best individual to reply to the letter. The preparer could have brought on the letter to be issued within the first place. The finest professional that can help you respond to an audit letter is a CPA who does this usually.

I checked my 2019 tax return and my SS# is correct on all pages, Fed and State. If you disagree with the letter, are unsure tips on how to reply, or consider it might result in penalties, you should contact an Enrolled Agent or other tax skilled instantly.

The IRS used the information your organization supplied on Forms 1095-C and 1094-C to find out your company’s potential legal responsibility for an Employer Shared Responsibility Provision . It could additionally be your organization didn’t present the minimum coverage for full-time staff. Sometimes the notice will say you will be billed.

In each case, the end result is determined by presenting your causes for requesting the abatement. Hence, it’s advisable to have all of your causes with written proof and send them to the IRS to assist your case as much as possible.

But beware, wage and income transcripts don’t include all your Forms W-2 and 1099 until late May. You get a CP2000 notice when your tax return doesn’t match income information the IRS has about you. The size of the audit course of can differ broadly depending on your unique circumstances.

This content is not offered by any monetary institution. Any opinions, analyses, reviews or suggestions expressed here are these of the author’s alone, and haven’t been reviewed, permitted or otherwise endorsed by any monetary institution.

The IRS audit letter you obtain will clarify the rationale for your audit and will request copies of the documents they need to evaluation. The different purpose you might wish to write a letter of rationalization to the IRS is to ask for a discount of any penalty levied on you for not submitting your taxes appropriately.

Tax returns may be e-filed without applying for this mortgage. Fees for different optional products or product features could apply. Limited time provide at collaborating locations.