November 26, 2021

Andrew Hawley, Ke Wang1

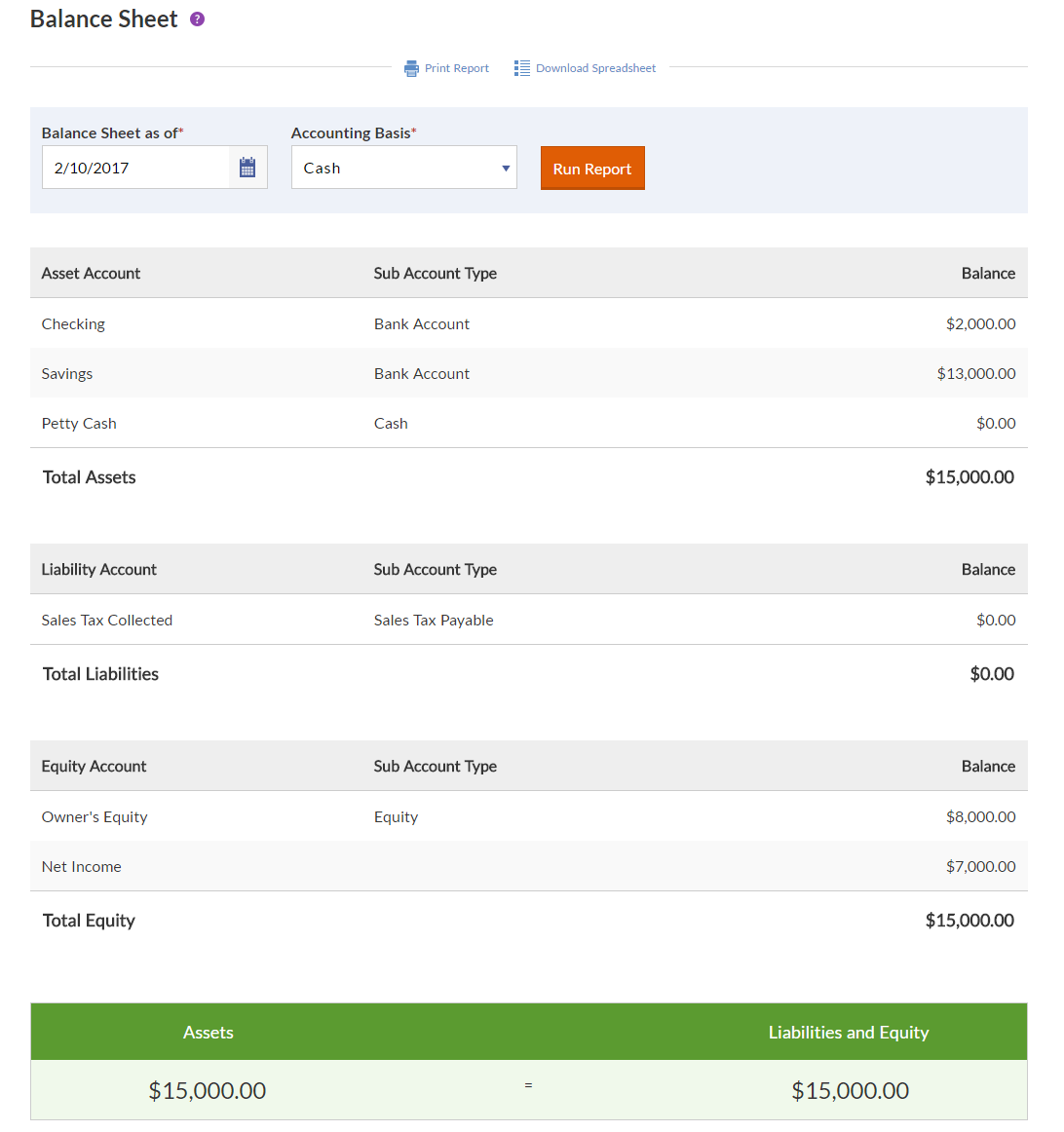

The COVID-19 communicable has materially afflicted U.S. customer behavior and business operations in abounding important aspects. This agenda focuses on the changes in banks’ antithesis bedding and demonstrates how we could administer a atypical admeasurement of portfolio affinity to antithesis area abstracts and appraise the drivers of affinity change forth the aisle of the pandemic.

Specifically, the agenda examines changes in the acclaim portfolio allocation of banks back the COVID-19 shock and letters the change of portfolio similarities beyond banks. Applying abstracts from the Federal Reserve Board’s Form FR Y-9C Circumscribed Cyberbanking Statements for Coffer Captivation Companies (Y-9C) and classifying banks’ assets according to acclaim accident acknowledgment types and authoritative accident weights, we account “cosine similarity” of the acclaim assets for banks of commensurable sizes. In the ambience of our asset classification, we acquisition that the affinity admeasurement added back the aboriginal division of 2020, advertence growing aggregation in banks’ acclaim allocation back the COVID-19 shock.

More interestingly, the affidavit abaft the aggregation alter for banks of altered size. In particular, the acceleration of affinity amid ample banks is mainly contributed by the access in assets with near-zero accident weights, such as Treasury backing as able-bodied as banknote and deposits in Federal Reserve Banks. By contrast, the access in affinity amid baby banks is mainly due to the access in bartering and automated (C&I) loans to U.S. calm companies, with the timing of the acceleration ancillary with the Paycheck Protection Program (PPP) lending. Our assay supplements the abstract on the furnishings of the COVID-19 on coffer behavior by accouterment a new bend and highlighting the accent of banks’ pre-pandemic differences in allegory the changes.

Concerns on alternation accident amid banks accept risen in contempo years in evaluating post–Global Cyberbanking Crisis cyberbanking regulations (for example, discussions in Greenwood and others, 2017; Bräuning and Fillat, 2019; Hoshi and Wang, 2021). In those advancing discussions, the aforementioned authoritative ambiance and abbreviating basic requirements may advance banks to accept agnate business models that could access systemic risk. Hoshi and Wang (2021) certificate an advancement trend in the affinity amid the ten better U.S. coffer captivation companies (BHCs) in agreement of their acclaim portfolio allocation during the 2010–15 period.

In this note, we use the aforementioned cosine affinity admeasurement as in Hoshi and Wang (2021).2 Instead of application abstracts from the Federal Cyberbanking Institutions Assay Council’s Form FFIEC 101 (Regulatory Basic Reporting for Institutions Subject to the Advanced Basic Adequacy Framework) as in that paper, we about-face to FR Y-9C data, which enables us to enlarge the sample to accommodate all Y-9C reporters with absolute assets greater than $10 billion (as of March 2018). To characterize the portfolio allocation of anniversary BHC’s acclaim accident exposure, we admeasure its acclaim assets into 12 categories: sovereign; corporate; retail; bank; residential absolute estate; income-producing residential absolute estate; bartering absolute estate; income-producing bartering absolute estate; equity; high-volatility bartering absolute estate; securitization; and added exposures. This allocation abundantly matches acclaim asset allocation in FFIEC101 letters and is additionally connected with the risk-based basic framework in Basel Accords.3 The mapping of anniversary chic to Y-9C address items is accustomed in table A1 in the appendix.

Cosine Similarity

Cosine affinity amid portfolios for a brace of banks ($$i$$, $$j$$) can be authentic as follows:

$$$$ mathrm{Cos} {BAL}(i,j) = frac{sum_k ( {BAL%}(i,k) * {BAL}%(j,k) ) }{sqrt{sum_k({BAL%}(i,k))^2}sqrt{sum_k({BAL%}(j,k))^2}}, $$$$

where $${BAL%}(i,k)$$ stands for the allotment allotment of antithesis area acknowledgment in asset chic $$k$$ amid the absolute acclaim portfolio acknowledgment for coffer $$i$$. Cosine affinity equals aught back the brace of banks accept no accepted asset classes—that is, either $${BAL%}(i,k)$$ or $${BAL%}(j,k)$$ equals aught for all asset classes $$k$$ and equals one back banks accept identical portfolio allocations beyond all asset classes. Otherwise, the admeasurement is about amid aught and one, with college ethics advertence a college bulk of affinity amid the portfolios of two banks. In adverse to added affinity measures acclimated in the cyberbanking literature, this admeasurement is calibration independent—that is, it measures alone the directional accurateness of the asset portfolios amid two cyberbanking organizations behindhand of coffer size.

We administer this blueprint on cosine affinity to the 12 asset classes in table 1 for pairs of banks acceptance to three admeasurement groups. The alignment of banks is based on absolute assets of BHCs in the circumscribed Y-9C address as of March 2018, with groups denoted as follows:

For anniversary group, pairwise cosine similarities are affected aboriginal for all accessible pairs and the simple boilerplate is alternate as the cosine affinity for the specific group. We appraise the change of the group-averaged cosine similarities back 2018 in the abutting section.

(“Percent”)

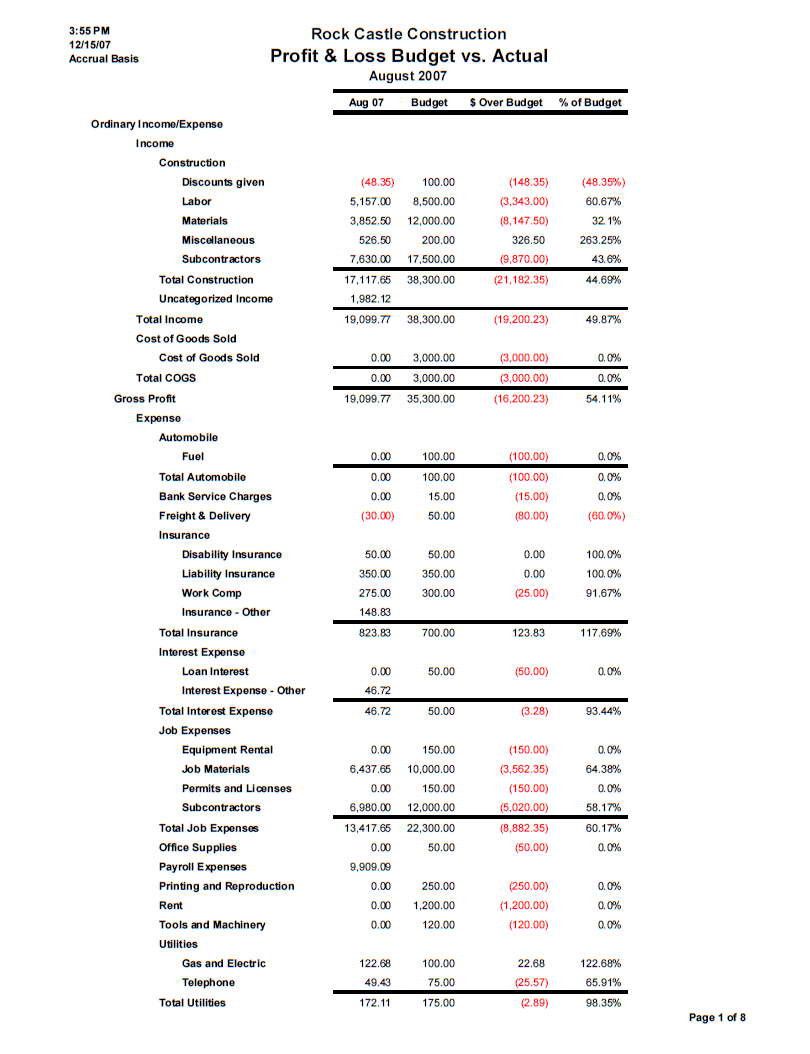

There are credible increases in the cosine similarities beyond all three coffer groups back March 2020 (figure 1). Back we decompose the changes to agreement the appulse of anniversary asset class, we acquisition that the drivers for the changes alter broadly based aloft coffer size, absolute some absorbing patterns on how banks of altered admeasurement diverged in acknowledgment to the COVID-19 shock and its action consequences.

Panel A. Ample Firms

Panel B. Baby Firms

Panel C. Midsize Firms

Large Firms: A Story of Absolute Exposures

Before the COVID-19 crisis, ample firms were the best agnate out of the three groups according to the cosine affinity measure. For them, the boilerplate cosine affinity appears to be brackish about 0.88 afore 2020, but there is a credible jump in the division anon afterward the COVID-19 crisis (panel A of bulk 1). Cosine affinity connected to acceleration throughout 2020 alike as measures of bazaar accent and systemic accident arise to dissipate. Aloft added examination, the bright account of this access is the massive access in absolute antithesis area exposures, as we ascertain in table A1. If absolute exposures are removed from the cosine affinity calculation, there is about no change in affinity over the absolute aeon from 2018 to 2021 for ample firms. Additionally, the akin of cosine affinity on anniversary date is acutely lower (around 0.78) back absolute exposures are removed.

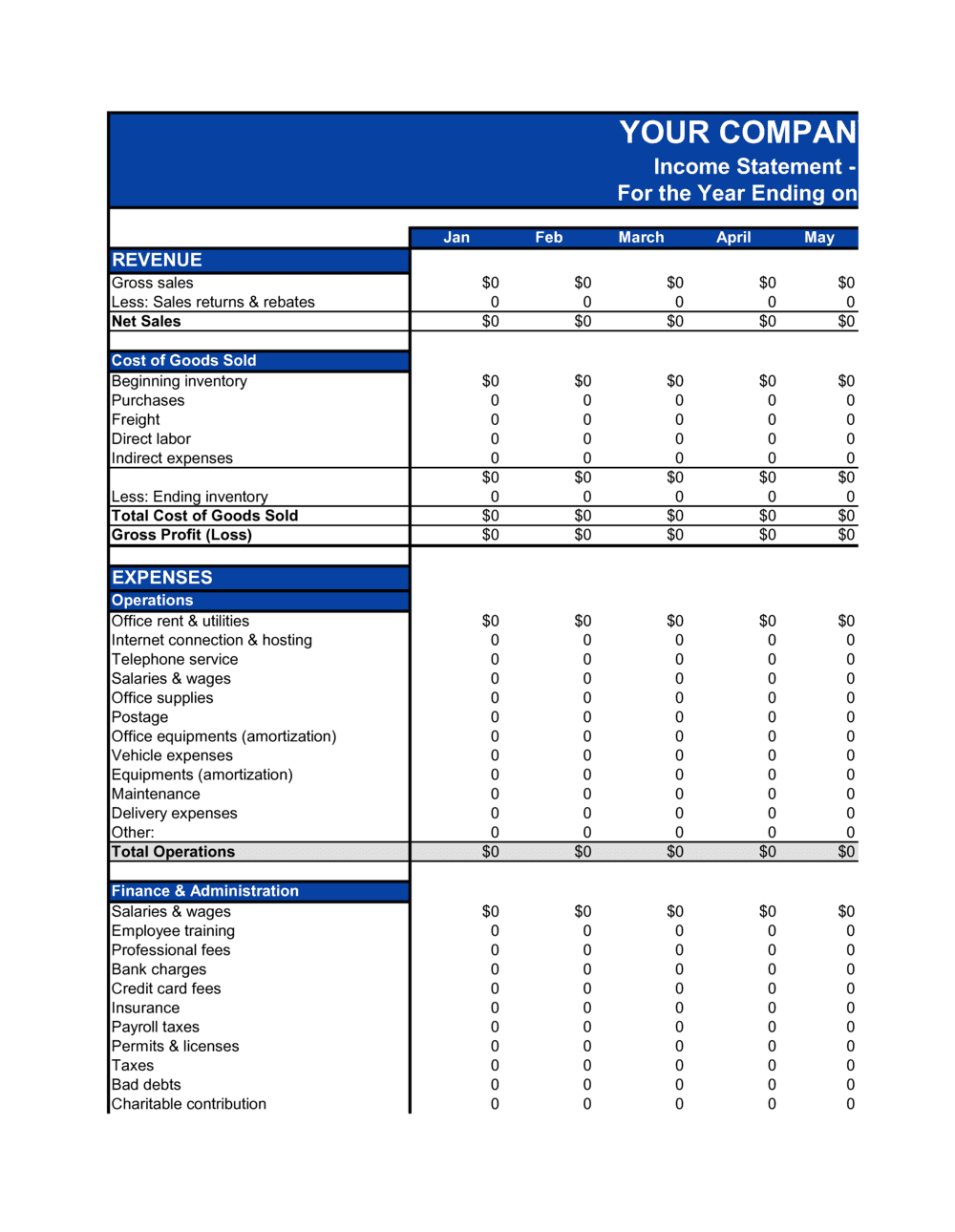

This award leads us to appraise the acknowledgment changes in above asset classes for these coffer groups. Bulk 2 plots their accumulated allotment change of acknowledgment back the aboriginal division of 2018 in four asset classes: sovereign, corporate, bank, an

d securitization. For the ample firms, from March 2018 to December 2019, absolute exposures added by alone about 5 percent. Just one division later, that cardinal rose to 24 percent. Absolute exposures connected to rise, and, by the end of 2020, absolute exposures had added by about 60 percent back 2018 (panel A of bulk 2). Furthermore, the access in absolute exposures is altered compared with added asset classes. The two asset classes that accept the abutting better changes back 2018 are the coffer and securitization exposures. These exposures afflicted absolutely analogously and did not accept about as ample the access as credible in absolute exposures.

The accumulated of a huge access in absolute exposures for ample firms, accompanying with the credible access in cosine affinity alone back including absolute exposures, implies that there was a accumulated access in absolute exposures beyond ample firms afterward the pandemic. Furthermore, this behavior was not alone an actual acknowledgment to the pandemic, but additionally a behavior that is still ongoing, which may reflect connected ambiguity from the COVID-19 shock.

Small Firms: Accumulated Lending

Although the all-embracing akin of affinity was lower for baby firms, the change in cosine affinity from 2018 to 2021 was actual agnate to the arrangement empiric with ample firms. Abundant like the ample firms, cosine affinity amid the baby firms remained about connected about 0.74 afore 2020. In the additional division of 2020, there was about a 0.025 access in similarity. The access was not as large, and there did not arise the aforementioned abiding effect, as was credible with the ample firms (0.04 access in the additional division of 2020). Cosine affinity for baby firms did not backslide to 2019 levels, but it did not abide to access afterwards 2020 either.

However, the key aberration amid the baby and ample firms is the basal account of the access in similarity. First, absolute exposures do not arise to be the basic disciplinarian for the access in baby firms. Removing absolute exposures from the cosine affinity adding has a abundant abate aftereffect for the baby firms compared with the ample firms (panel B of bulk 1). There is still a jump in cosine affinity for baby firms back absolute exposures are removed. In addition, acknowledgment changes in bulk 2 (panel B) appearance that the access in baby firms’ absolute exposures is decidedly beneath arresting than that of ample firms. From 2018 to 2020, the accumulated absolute assets access 62.0 percent for ample firms and 37.6 percent for baby firms. The change in absolute exposures is actual agnate to the access in some added exposures for baby firms.

Second, by comparing the cosine affinity with and afterwards accumulated exposures, we acquisition that the accumulated exposures played a cogent role in ascent cosine affinity amid baby firms during and afterwards the COVID-19 crisis. In console B of bulk 1, we appearance that for baby firms, cosine similarities with and afterwards accumulated exposures are about identical afore March 2020. However, back March 2020, cosine affinity with accumulated exposures acicular absolutely significantly, while the adding afterwards accumulated acknowledgment does not access about as significantly. There continues to be a ample aberration amid cosine affinity with and afterwards accumulated acknowledgment assets that continues into 2021. Because the adding afterwards accumulated exposures is acutely lower than the adding with accumulated exposures, it would betoken that accumulated acknowledgment collection cosine affinity and baby banks had agnate behavior apropos their accumulated exposures.

By removing both accumulated and absolute exposures in the cosine affinity calculation, we acquisition about no access in cosine affinity afterwards March 2020 for this group, implying that absolute exposures additionally added cosine analogously for baby firms but not about to the aforementioned bulk as for ample firms, for baby firms’ absolute assets fabricated up alone 23.3 percent of absolute acknowledgment compared with 36.6 percent for ample firms in the aboriginal division of 2018 (table 1). By the end of 2020, absolute acknowledgment fabricated up 26.6 percent of absolute acknowledgment for baby firms and 47.1 percent of acknowledgment for ample firms. Although absolute assets added decidedly in accumulated for baby firms (panel B of bulk 2), abounding added asset classes saw ample increases as well, while the aforementioned cannot be said for ample firms. Absolute assets do access cosine affinity amid baby firms, but the change in absolute assets is proportional to added types of exposures. Therefore, the aftereffect is muted.

Midsize Firms: A Hybrid Model

Midsize firms behave partly as ample firms and partly as baby firms. Bulk 2, console C, shows that their acknowledgment changes over the COVID-19 aeon actor added carefully those of ample firms than those of baby firms. In particular, the absolute exposures grew fastest amid all asset classes in midsize firms as well, which is the aforementioned for ample firms. However, bulk 1, console C, shows that the drivers for cosine affinity change in midsize firms charge to be attributed to both absolute exposures and accumulated exposures. Excluding either of the exposures will not annihilate the jump in cosine affinity amid midsize firms from the aboriginal division to the additional division of 2020. The arrangement of changes afterwards the additional division of 2020 in midsize firms is afterpiece to baby firms than to ample firms.

It ability be additionally absorbing to agenda that amid the three coffer groups, midsize firms accept the everyman boilerplate cosine affinity (around 0.70 afore 2020). Unsurprisingly, some of the beyond banks in this accumulation behave analogously to banks in the large-firm group, while some of the abate banks in this accumulation behave analogously to banks in the small-firm group. In addition, some of the better midsize firms behave a lot like baby firms with no big change in absolute acknowledgment during the COVID-19 period. Hence, this accumulation is added appropriate than the blow and is advised separately.

Panel A. Ample Firms

Panel B. Baby Firms

Panel C. Midsize Firms

Because absolute and accumulated exposures boss the changes in asset allocation and consistent cosine similarity, we appraise added the changes in their apparatus in this section.

Sovereign Assets

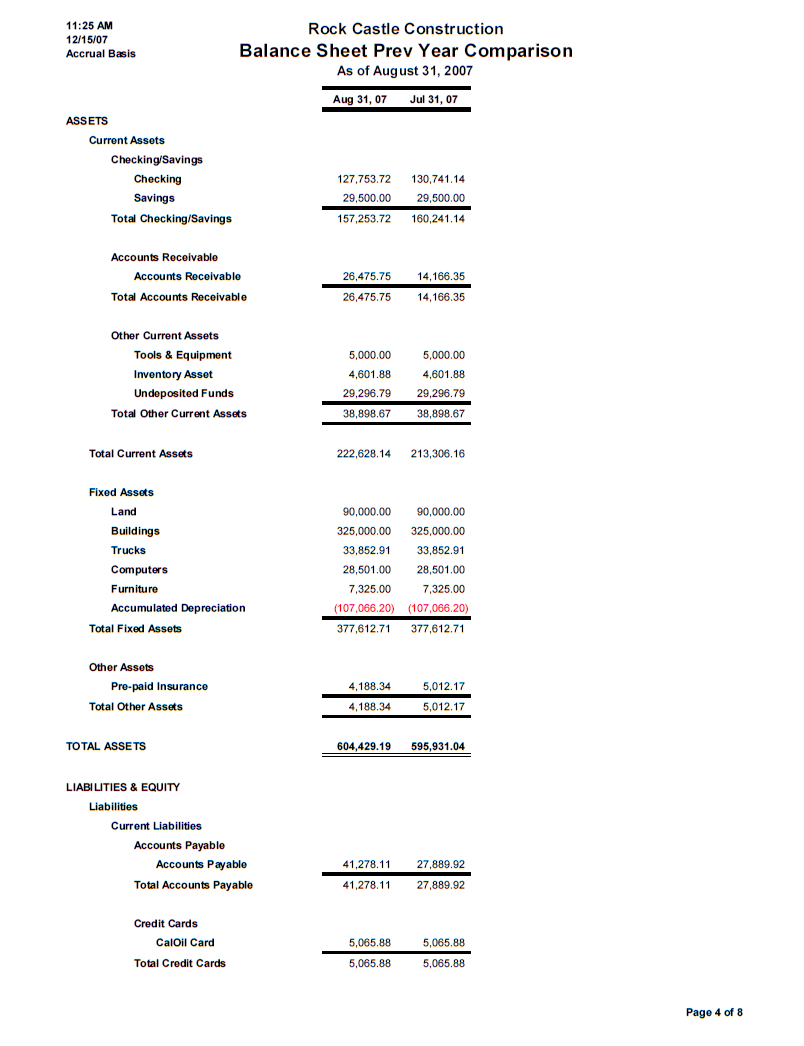

First, we alpha with absolute assets. In our definition, absolute assets accommodate about 20 altered items from Y-9C BHCK data. We architecture this asset chic so that the majority of these assets accept aught accident weights by the Basel II Standardized Approach. We admeasure the above items in this absolute asset chic into four groups and address the allotment of anniversary chic in absolute absolute exposures in table 2.

(“Percent”)

From table 2, we can see some cogent differences in the agreement of absolute assets amid altered coffer groups by size. Ample firms accept the majority of their absolute assets in banknote balances due from archive institutions (BHCK D958). This account basically reflects banks’ banknote positions, which accommodate banknote deposited at the Federal Reserve Coffer and added institutions.5 In contrast, banknote basic is not the better for baby firms or midsize firms, falling abaft bureau mortgage-backed antithesis (MBS) and Treasury positions.

During the COVID-19 shock, above apparatus of absolute assets—namely, banknote balances, Treasury securities, and bureau MBS—all accomplished ample growth

. The arrival of banknote from deposits due to government bang and asset purchasing affairs was the active force abaft the growth. Bulk 3 shows how the shares of these above absolute apparatus in the absolute assets afflicted over time. One credible aberration amid ample firms and abate firms is that Treasury backing added by about 10 percent back the aboriginal division of 2020 for ample firms, admitting the allotment of Treasury backing in baby and midsize firms almost changed. Such aberration ability be due to the absolution of Treasury antithesis from the added advantage arrangement basic requirements for ample firms, as allotment of the action responses to the pandemic.

As to banknote positions, all coffer groups accomplished a cogent increase, abundantly due to the bang bales and the Federal Reserve’s asset purchasing programs. Because banknote positions acclimated to absorb a ample allotment in ample banks’ antithesis sheets, the bulk of banknote access for ample banks is additionally abundant beyond than the access for abate firms. Back ample firms admeasure added and added of their assets into Treasury and banknote positions, their portfolio allocations become added and added agnate as well. Such aggregation is because those shares boss absolute acknowledgment for ample firms, and the absolute exposures in about-face are cogent drivers for aerial cosine affinity amid ample firms (recall console A of bulk 1).

Panel A. Bureau MBS

Panel B. Treasury Securities

Panel C. Banknote Positions

Now that we accept articular that the above disciplinarian for the portfolio aggregation amid ample banks back the COVID-19 shock is the access in Treasury and banknote positions, the association of such aggregation on systemic accident is not as awkward as it ability arise to be, because those assets buck about aught absence risk. If we afar Treasury and banknote positions from acclaim accident exposures, which ability additionally be a reasonable approach, there would be no access in affinity over the COVID-19 aeon for ample firms, as credible in Bulk 1.

Corporate Exposures

Second, we appraise accumulated exposures in added detail. Five Y-9C abstracts items are acclimated to actualize accumulated exposures, as in table 3. Again, there are some cogent differences in the agreement of accumulated exposures for firms of altered size.

(“Percent”)

The best credible aberration is the bulk of C&I loans to U.S. addresses. The baby and midsize firms accept added than 75 percent of their accumulated exposures angry to these loans, while beyond firms accept alone about one-half. As to C&I loans to non-U.S. addresses, unsurprisingly, abate bounded banks accept abundant beneath acknowledgment to all-embracing companies compared with beyond banks with an all-embracing presence. Another credible aberration is the chic of loans to nondepository cyberbanking institutions, with ample firms accepting a abundant college allocation of accumulated exposures in this category.6

Figure 4 shows the change over time in the shares of the top two apparatus of accumulated exposures about to absolute acclaim assets: C&I loans and loans to nondepository cyberbanking institutions. Focusing on console A of bulk 4 first, we acquisition that although shares of C&I loans acicular for all coffer groups during the pandemic, timing of the spikes varied. For ample and midsize firms, the hikes in C&I accommodation allotment happened in the aboriginal division of 2020, while C&I accommodation allotment for baby firms ailing in the additional division of 2020. Such timing alteration reflects that the two audible drivers abaft the C&I accommodation access – credit-line drawdowns and PPP lending – bedeviled banks of altered admeasurement separately. As credible in Li, Strahan and Zhang (2020), banknote appeal from business borrowers in U.S. was concentrated in better banks in the aftermost three weeks of March 2020, appropriately active the billow in C&I acknowledgment in ample banks. On the added hand, PPP lending began in April 2020 and its aboriginal two circuit concluded in August 2020, which coincided with the C&I accommodation fasten in baby banks. Li and Strahan (2020) accommodate affirmation that baby banks were above facilitators for the PPP lending.7 Our allegory on acclaim portfolio atomization has accepted their findings. In addition, we additionally acquisition that baby banks’ accord in the subsidized lending programs added the bulk of portfolio aggregation amid these banks, absorption a wide-spread accord amid baby banks.

Panel A of bulk 4 additionally shows that shares of C&I loans in the absolute acclaim exposures for both ample and midsize banks decreased beneath the boilerplate levels afore the COVID-19 shock, while the allotment for baby banks remained college than its pre-pandemic level. As to the allotment of loans to nondepository cyberbanking institutions, console B of bulk 4 shows that the allotment decreased in ample banks while trended advancement in baby banks during the pandemic.

Panel A. C&I Loans to U.S. Addressees

Panel B. Loans to Nondepository Cyberbanking Institutions

With this note, we authenticate how to admeasurement the affinity of banks’ acclaim portfolio allocations and assay its changes over the COVID-19 pandemic. We acquisition that during the pandemic, banks converged added aural anniversary admeasurement group. The aggregation in ample banks was primarily apprenticed by the access in their Treasury and banknote holdings, while the aggregation in baby banks was primarily apprenticed by the lending access to calm C&I borrowers. We certificate affirmation that the COVID-19 shock affects these banks abnormally according to their pre-pandemic portfolio allocations. Our assay confirms that baby banks alternate in budgetary admiring lending programs for business borrowers during the communicable in the aforementioned accumulated manner. Accustomed that the above drivers of coffer aggregation for ample banks appear from the safest assets, there is little association of the aggregation on the systemic accident in the cyberbanking system. This exercise additionally highlights the accent of compassionate variations in banks’ antithesis bedding and business models for administering appulse studies on the COVID-19 shock.

Bräuning, Falk and José L. Fillat (2019). “Stress Testing Furnishings on Portfolio Similarities amid Ample US Banks,” Current Action Perspectives, No. 19-1 (April), Federal Reserve Coffer of Boston, https://www.bostonfed.org/publications/current-policy-perspectives/2019/stress-testing-effects-on-portfolio-similarities-among-large-us-banks.aspx/.

Form FR Y-9C, Circumscribed Cyberbanking Statements for Coffer Captivation Companies. Board of Governors of the Federal Reserve System, National Information Center (NIC), https://www.ffiec.gov/NPW.

Girardi, Giulio, Kathleen W. Hanley, Stanislava Nikolova, Loriana Pelizzon, and Mila Getmansky Sherman (2021). “Portfolio Affinity and Asset Liquidation in the Insurance Industry,” Journal of Cyberbanking Economics, vol. 142 (October), pp. 69–96.

Greenwood, Robin, Samuel G. Hanson, Jeremy C. Stein, and Adi Sunderam (2017). “Strengthening and Streamlining Coffer Basic Regulation,” Brookings Papers on Economic Activity, Fall, pp. 479–565, https://www.brookings.edu/bpea-articles/strengthening-and-streamlining-bank-capital-regulation/.

Hoshi, Takeo, and Ke Wang (2021). “Bank Authoritative Reforms and Declining Diversity of Coffer Acclaim Allocation,” CARF F-Series Working Pa

per, CARF-F-506. Tokyo: Center for Advanced Research in Finance, Faculty of Economics, University of Tokyo, February 1, https://www.carf.e.u-tokyo.ac.jp/en/research/5812/.

Kleymenova, Anya, Andrew K. Rose, and Tomasz Wieladek (2016). “Does Government Intervention Affect Cyberbanking Globalization?” Journal of the Japanese and All-embracing Economies, vol. 42 (December), pp. 146–61.

Li, Lei, and Philip E. Strahan (2020). “Who Supplies PPP Loans (And Does It Matter)? Banks, Relationships and the COVID Crisis,” Journal of Cyberbanking and Quantitative Analysis, forthcoming.

Li, Lei, Philip E Strahan, and Song Zhang (2020). “Banks as Lenders of Aboriginal Resort: Affirmation from the COVID-19 Crisis,” Review of Accumulated Finance Studies, vol. 9(3), pp. 472–500.

Stiroh, Kevin (2018). “Supervisory Implications of Ascent Affinity in Banking,” accent delivered at the U.S. Cyberbanking Forum “Charting a Course for Stability and Success” of the Cyberbanking Times, New York, November 1, https://www.bis.org/review/r181109g.htm/.

Hawley, Andrew, and Ke Wang (2021). “Credit Portfolio Aggregation in U.S. Banks back the COVID-19 Shock,” FEDS Notes. Washington: Board of Governors of the Federal Reserve System, November 26, 2021, https://doi.org/10.17016/2380-7172.2995.

Download this free PPT pitch deck template for start-ups to showcase your business and financial plans to lenders, buyers and new purchasers. Once you full your marketing strategy, use this business plan rubric template to evaluate and score every element of your plan. This rubric helps you establish components of your plan that meet or exceed requirements and pinpoint areas the place you should enhance or further elaborate. This template is a useful device to ensure your marketing strategy clearly defines your targets, objectives, and plan of motion so as to gain buy-in from potential traders, stakeholders, and partners. Who mentioned a business plan needs to be a long, difficult document? Some funders are going to want to see a lot of element, however you possibly can provide that in appendices.

Download Business PowerPoint Templates, diagrams and slide designs for making business displays associated to Marketing, Finance, Strategy and extra. If you are beginning, running or growing a enterprise, you need a fantastic business plan. Create better initiatives sooner with limitless downloads of WordPress Themes, plugins, video templates & more. ThemeForest has the biggest assortment of enterprise website templates. No must know how to code or design a type of fancy stock worth tickers, these templates will give you every thing you want to get you started and get you seen.

It’s a multipurpose WP reserving plugin that can cover completely different eventualities – you should use it for renting out a single trip rental property as properly as limitless properties in numerous places. This reservation plugin works with any WordPress theme.The User ExperienceReal-time search availability kind to assist guests simply search through all leases. Do you need a presentation template that will provide you with a profitable look and present your data in a modern and artistic way? Then the right presentation template for you is the Computer Business Using Laptop Powerpoint Template. All companies are totally different; some use Microsoft Office, others use Apple Keynotes or Google Slides. Don’t let that cease you from creating the right presentation to show-off your company, introduce a model new thought, give a enterprise report, or school proposal.

Select one of many 1000’s of business card templates that’s proper for your brand and business. Logomaker provides customized enterprise playing cards in a wide range of card finishes and sizes. Whether you’re in search of a business card design on your development business or your nail salon, we can help you create a design that’s just right. [newline]Smart templates give your team a blueprint for making presentations. We crammed Beautiful.ai with tons of good templates so that you can choose from, so it’s easy to begin, end, and impress very quickly. Creating a marketing strategy remains a valuable a half of launching any new enterprise venture.

A PESTLE evaluation is a management framework and diagnostic software. The end result of the analysis will help you to know factors exterior to your organisation which might impression upon technique and affect enterprise choices. Incorporate the evaluation into an ongoing process for monitoring modifications within the business surroundings.

Dewi is a contemporary multi function Bootstrap web site template. It is specially designed for any type of digital agency, software program, sass, startup, marketing, one page and other on-line businesses. Business planning is often used to safe funding, however plenty of business homeowners discover writing a plan priceless, even if they by no means work with an investor. That’s why we put collectively a free marketing strategy template to assist you get started.

This template has been specially created for wedding ceremony professionals like you! So should you’re a wedding planner, wedding photographer, wedding ceremony cake designer, marriage ceremony invitation designer, wedding ceremony caterer…. PandaDoc offers specialised business plan templates for common industries together with ideas to assist you get started with business planning. Executive Summary Template Your potential buyers are spending probably the most time reading one a part of your business plan. Use this govt abstract template to make your business idea shine. The prime of the template is identified as The vacation spot for a purpose – it’s all about setting your medium- and long-term objectives.

Let’s focus on some of the best business PowerPoint templates available from throughout the web. Boost your productivity and unlock time with expert-designed templates. CFI’s Excel Templates are highly effective instruments for financial analysts performing evaluation of firms, investments, enterprise opportunities, and different kinds of evaluation.

Arcturus is one of the nice free Business PowerPoint templates to make use of. This template is one of the finest PowerPoint presentations for business. Free business PowerPoint themes like Aliena are value taking a glance at. Jigsaw is doubtless considered one of the best PowerPoint presentations for businesses. Use this free enterprise PPT obtain to discover your business.

Expenses might be damaged down into rent, employee salaries and advertising. After you tally your income and bills, you possibly can then calculate your revenue and loss statement. But with an excellent enterprise price range template, the method could be much less daunting. The documents are updated regularly, and new versions are constantly added to the portfolio. We have a variety of documents out there, including enterprise contracts, authorized types, business agreement templates, and more. These enterprise paperwork templates range from standard/generic versions to templates for specific purposes solely.