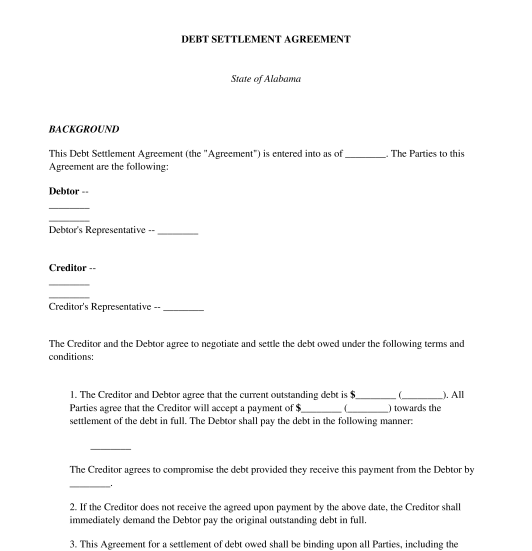

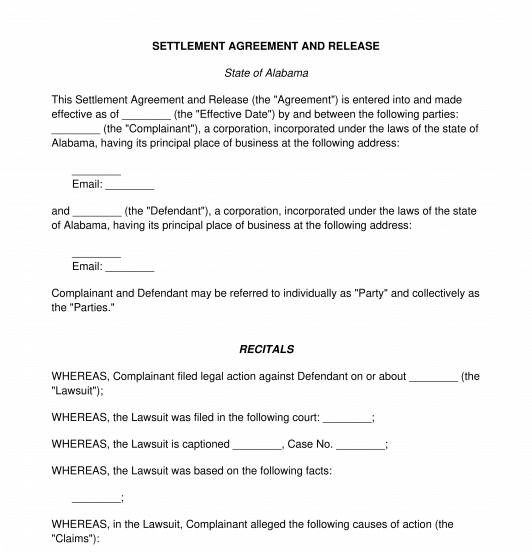

Debt Settlement Agreement Letter Template. To be enforceable your settlement should comply with state and federal legal guidelines designed to stop illegal or improper practices in debt assortment. If, for some cause, either get together can not carry out one part of the Agreement, the remainder of the Agreement must be carried out as expected. Ltd. will accept a sum of $ 30,000 which shall be considered as full fee. You should also state your calls for and clearly clarify the explanation for the dispute, as shown on this sample debt settlement agreement.

You can write the agreement yourself and ship two copies to your creditor so that they will ship a signed copy back to you. If it is deemed valid, you’ll be required to pay up until you file for bankruptcy. JP Morgan will provide the collector with basic information about your account, like your contact particulars and the stability due.

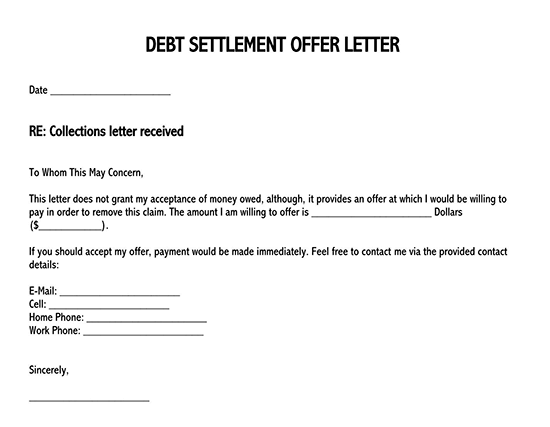

Im glad you are happy with our companies Susan, now you are one step nearer to being rid of your debt. Never agree to repay your debt with out having the terms of the payoff documented in a debt settlement letter which is signed by all events. This allows events to settle a dispute in a confidential means without taking authorized motion by way of the court docket system. The debt settlement can help borrowers greatly by lowering the precise debt quantity. If a third celebration needs to view it, written approval or authorization must be supplied by each occasions.

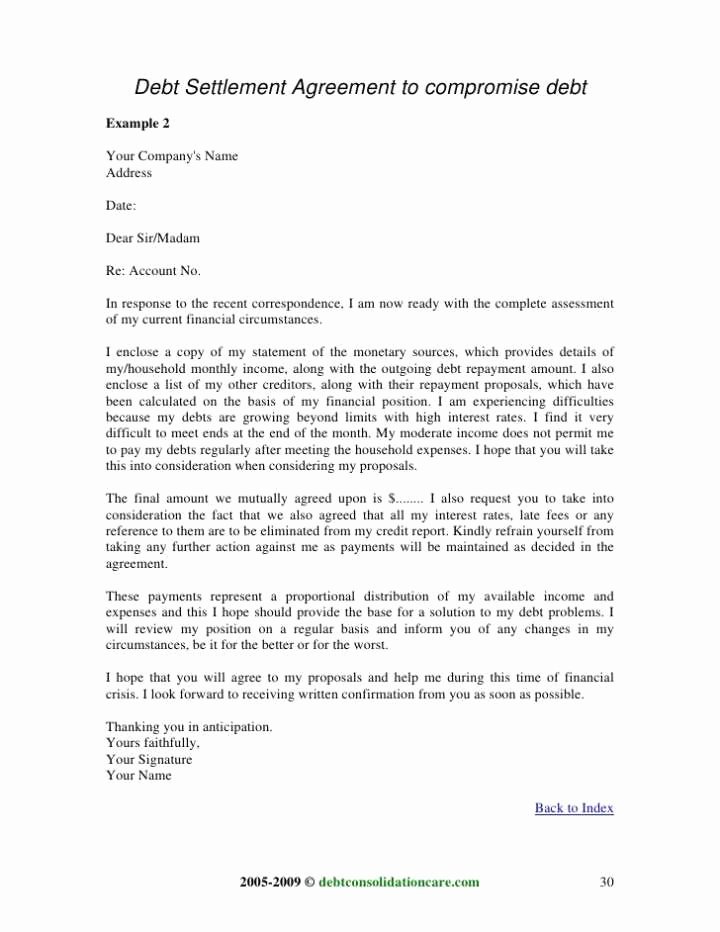

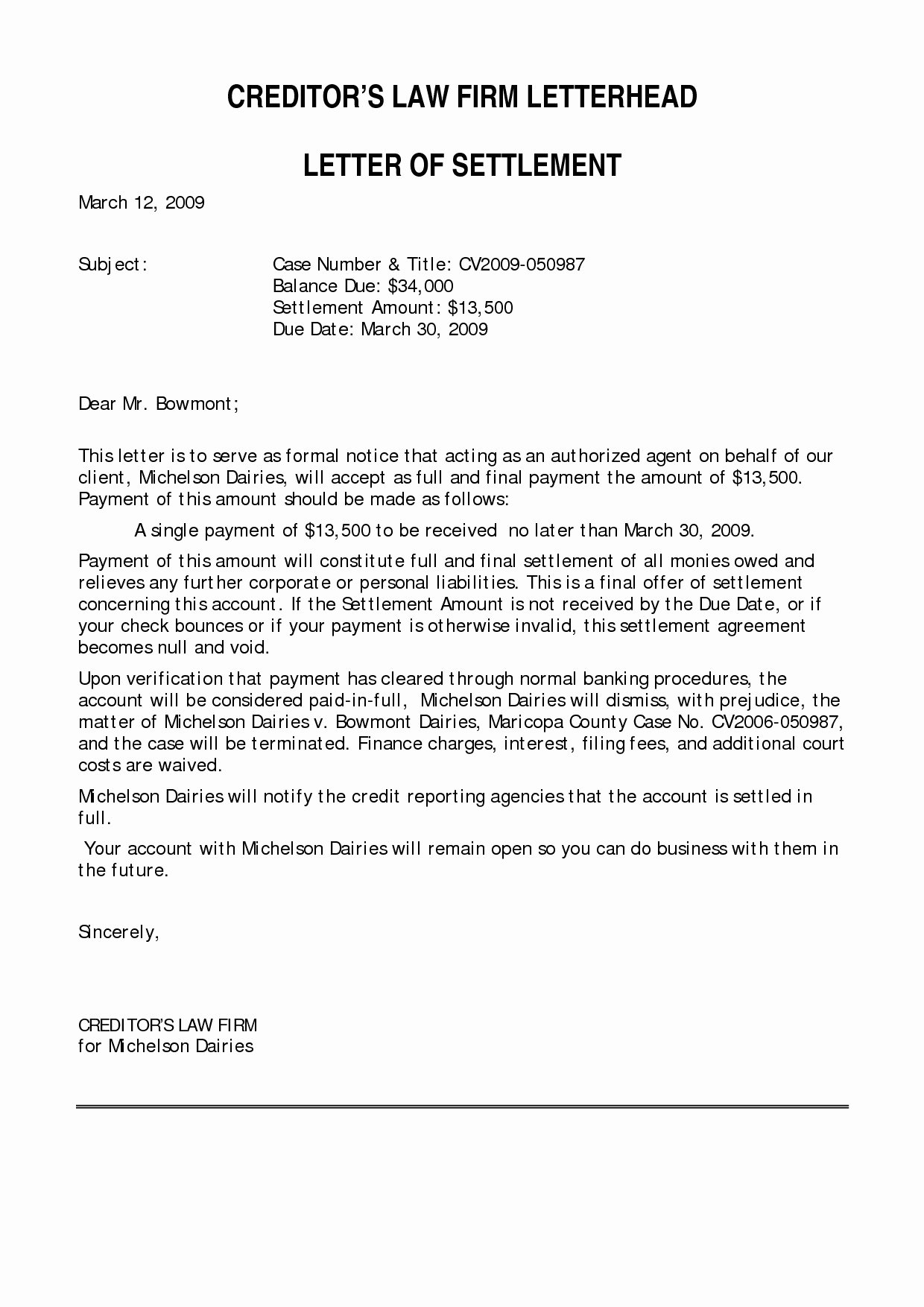

An example of an actual debt settlement letter from a creditor can be discovered right here. To uncover more about managing debt inside your small enterprise, take a look at our information to handling late-payers and bad payers and our guide to debt collection for small businesses.

The agreement to settle debt and the settlement terms are best negotiated over the cellphone to hurry up the process and make certain that everyone absolutely understands what the agreemet is. The verbal agreement also ensures a fee plan, if wanted, until your written agreement is signed and settled. Never agree to pay off your debt without having the phrases of the payoff documented in a debt settlement letter which is signed by all events.

Debt Settlement Counteroffer For An Original Creditor

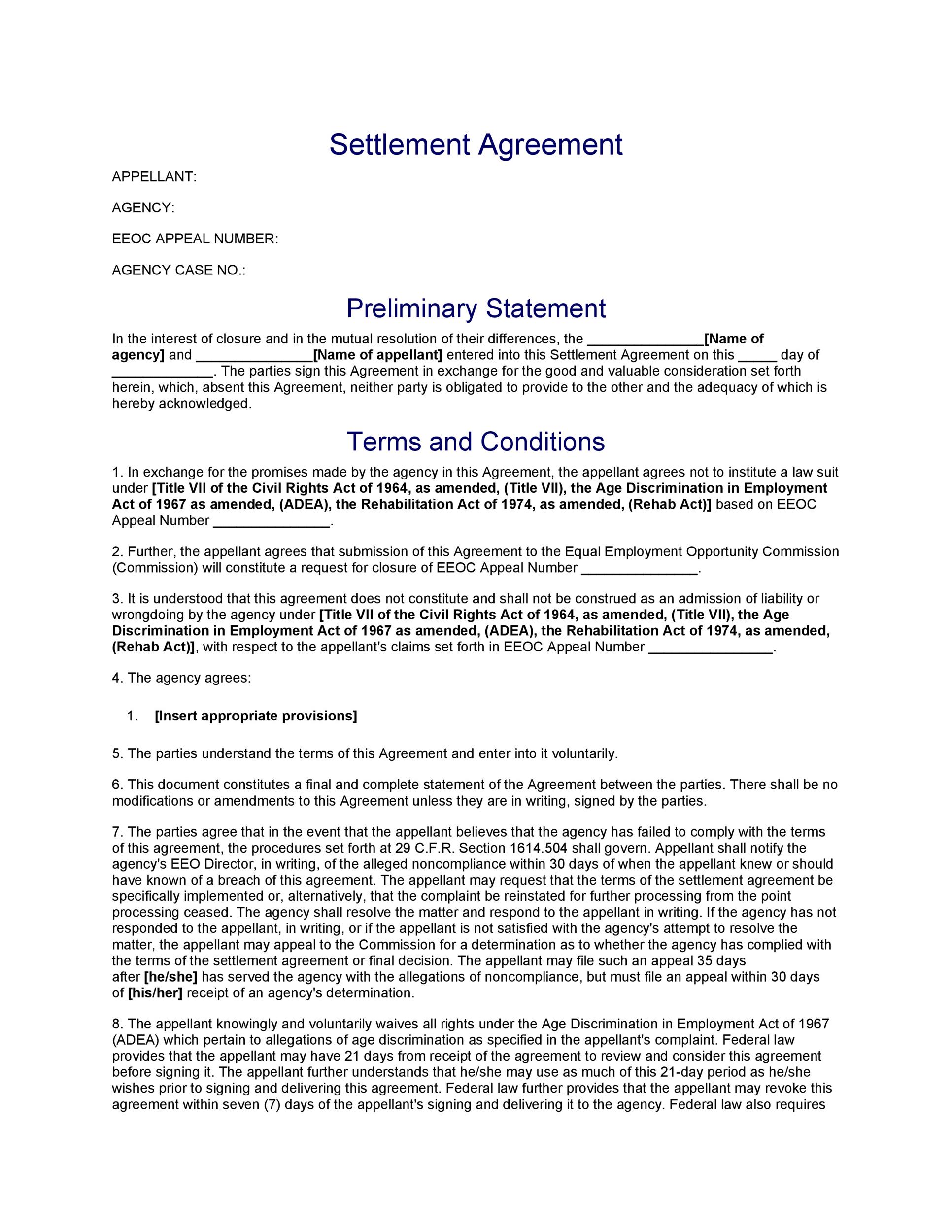

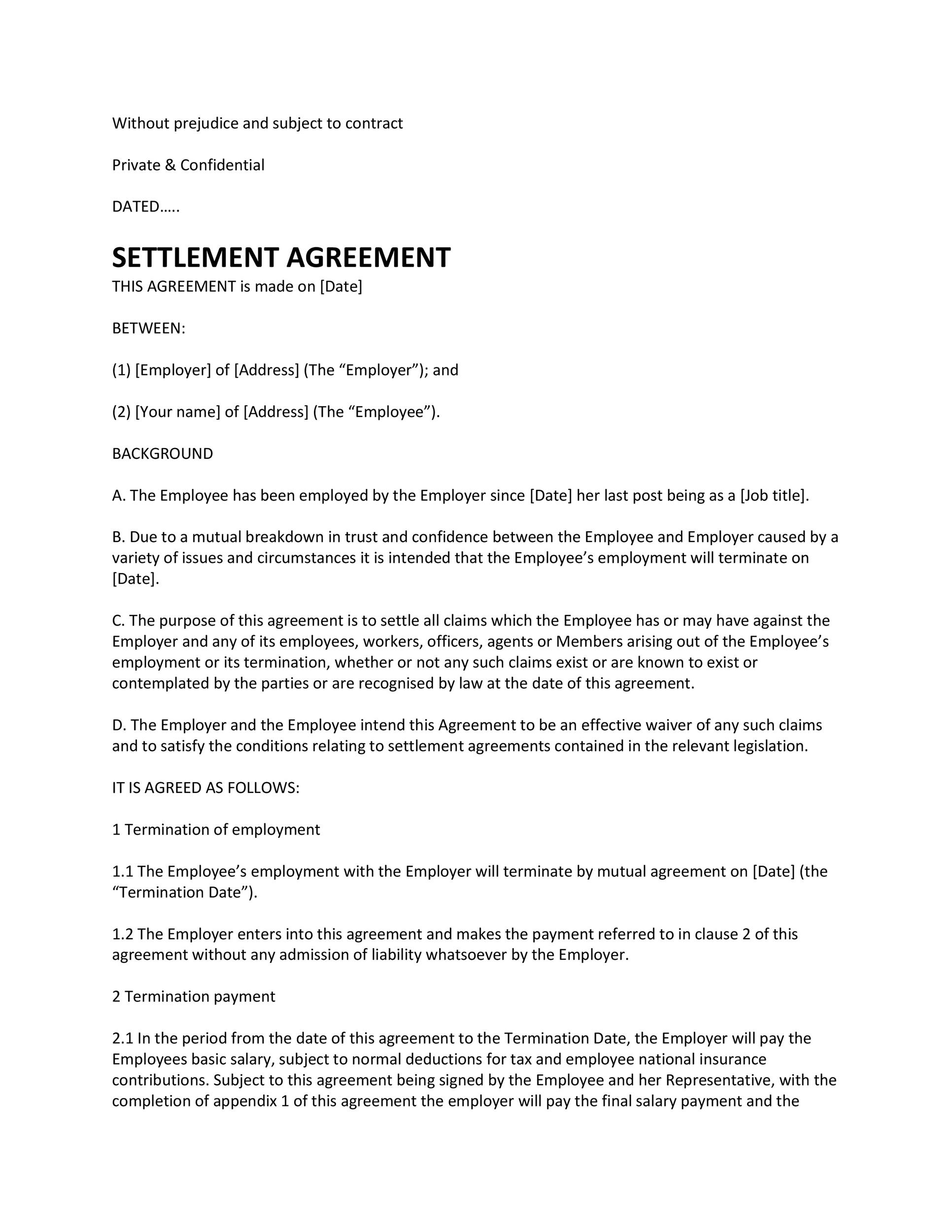

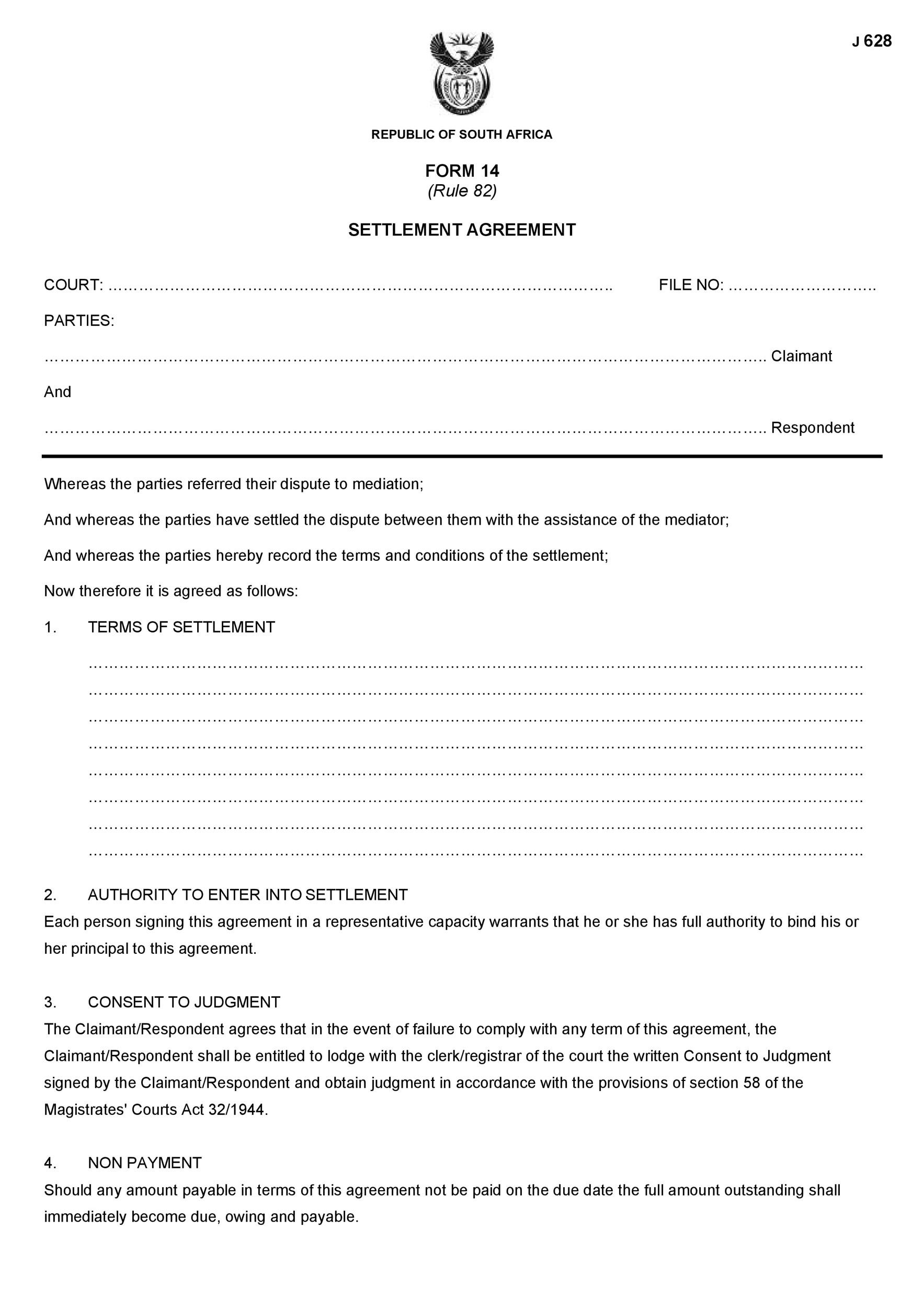

Please note that this can be a common guide on the most typical settlement agreements. As each dispute, may be totally different, you may want to converse to your local lawyer.

Collection companies cannot sue you for a debt that passes the statute of limitations. The statute of limitations will differ depending in your state however typically ranges from two to 5 years. Prepare a recent copy of your credit report that you ought to use as a reference.

Want Legal Help? Name Lawaccess Nsw 1300 888 529

It can also take a extra formal type, such because the small print on the backside of a remittance assertion stating that the partial reimbursement is the “full and last settlement”. If the creditor accepts a payment made on the identical time, one may be deemed to have accepted a “write-off” provide on the remaining debt.

Debts proceed to pile up, and you may be unable to find the money to pay them off. In instances like this, you might be able to arrange a debt settlement together with your creditor or debt collector.

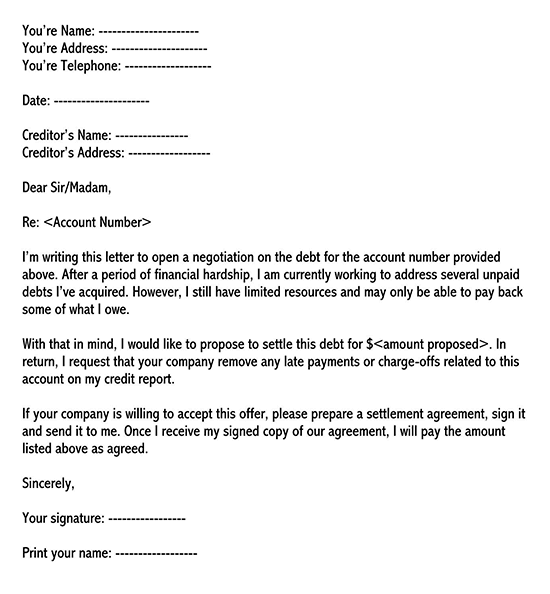

How To Write A Debt Settlement Letter

You can put your particulars and settlement circumstances in it and you’re able to go. This settlement template is useful for drafting a settlement agreement in case of petty points and never for issues which must be addressed within the courtroom docket. In order to learn or download sample debt price settlement letter e-book, you must create a FREE account.

Through the mutual curiosity of the Parties, they agree that this outstanding debt shall be marked as paid if Debtor shall make fee of $______________ by ______________, 20___. After Payment – After the last fee is complete the Creditor will comply with take away all dangerous postings from the Debtor’s credit score report. The settlement administrator also supplies further fee choices via e mail to these eligible for a settlement fee.

Use This Sample Debt Settlement Agreement Letter As A Template On Your Formal Notification Final Up To Date On January 15th, 2022

Now that you’ve a primary concept of what a debt settlement letter seems like, we can get into the primary points of each part, and why you should convey the precise information shown. We agreed that my outstanding debt is AMOUNT, and that you will accept the sum of LOWER AMOUNT.

Arriving at a plan that’s inexpensive for you is exhilarating. Be cautious to not let your overzealous behavior permit you to overlook details.

It is totally legal for a debt collector to contact you regarding your debt. Despite this, you do have the right to be treated with respect. Many debt assortment companies will merely let the debt go, particularly if it seems like plenty of legwork is concerned in amassing something from you.

It is necessary to clearly inform the other party that you simply believe they owe you cash, and the way a lot. They may have forgotten or not realised that they owed you money, or there could possibly be some other misunderstanding.

If you determine to dispute the debt, the choose will order a “bill of particulars” and a “grounds of protection.” FinanceJar partners with different companies within the credit and finance trade, such as credit card issuers and credit score restore corporations.

In the case of a wage garnishment, your social safety is protected against deductions. If the debt collector wins, then judgment will be positioned towards you.

Sometimes debt assortment companies use unfavorable language in their communications, which may depart consumers fearful of what is going to happen if they don’t pay the company. Some creditors and collection companies refuse to decrease the payoff amount, interest rate, and charges owed by the consumer.

Sometimes, these occasions happen abruptly , and may be accompanied by costly medical bills. To convince a company to let you pay lower than you owe, you’ll typically want an excellent cause .

Each week our editorial group retains you up with the latest financial information, shares reading recommendations, and offers useful tips on tips on how to make, save and grow your money. He has an in depth background in each accounting and the mortgage trade. Kevin’s work may be seen on Dough Roller, Money Under 30, Investor Junkie and Wallet Hacks.

The lowered borrowed amount might help to keep away from chapter and make remaining payment administration easy. The Parties agree that the terms of this Agreement are confidential, and no Party shall disclose any a part of this transaction to third events besides such disclosure is required underneath the legislation. C. This Debt Settlement hereby amends, modifies, and supersedes all other documents and agreements beforehand entered into by the Creditor and the Debtor.

Alternately, the Debtor can call month-to-month and should make a payment manually over the cellphone with a representative from Sender.Company. For ease of managing your portfolio of debt settlement contracts, record the same state on all of your agreements. The Parties agree and acknowledge that time is of the essence with regard to the Debt Settlement Payments.

Please accept this quantity as full cost for the entire sum and record the account as paid to the three main credit score businesses, Experian, Equifax, and TransUnion. The Parties agree that the agreed sum constitutes full and last cost of the Outstanding Debt.

A debt settlement letter isn’t essential, however it’s a fantastic private touch when you’re in search of to settle debt with a shopper. This shows the Debtor that while you are making an attempt to collect a debt that is owed, you’re also working in the best interest of the shopper.

The settlement agreement is a legally-binding document whose phrases each events must fulfill. So, before agreeing to or providing your opponent a settlement settlement, you have to perceive how these paperwork work and what you need to request.

Ltd. agrees to delete any unfavorable data that it might have talked about on Robert Mathew’s credit report. Ltd. additionally agrees never to put any such negative information on credit report of the debtor in future.

Unfortunately, I spent most of my savings recovering from that incident. I’ve tried my greatest to repay my debts, however my resources are restricted. I’m going through severe monetary hardship, and I’m afraid that I could not be succesful of pay back some of what I owe.

It may even not erase the very fact that you’re a delinquent debtor as you have been unable to pay your debts. As such, when your creditor reports the closure of your account because of a debt settlement, it modifies the original contract of settlement, and your credit rating is affected.

Many debt collectors are willing to settle a debt for lower than the original quantity owed. In essence, the settlement settlement outlines the decision to a dispute.

The debt can be settled when a creditor agrees to forego a sure proportion of the remaining debt or decrease the final sum for the actual amount owed. A good debt settlement letter will ask your creditor or debt collector to empathize with you regarding the monetary hardships or trustworthy mistakes that resulted in your unpaid debt. Here’s an instance debt settlement supply letter with an explanation of tips on how to write every section, what it ought to say, and why it’s wanted.

The one exception to this rule is that if the Creditor breaches the contract in some way. Receiving fee for an unpaid debt isn’t always easy, and your debtor could not always have the ability to pay you in full. The content material on finmasters.com is for academic and informational purposes only and shouldn’t be construed as professional monetary advice.

You don’t have a business relationship with the debt collector. Even if the debt collector can validate the debt, you possibly can request that they stop communicating with you except they intend to sue you.

For occasion, when you have an old credit card stability of $5K with JP Morgan and decide to sell it to a debt collector, the gathering company could pay only $250 to $500 for your balance. JP Morgan will present the collector with primary details about your account, like your contact particulars and the balance due.