Payoff Letter Template. In the face of such circumstances, is the lender required to supply a payoff letter at all and, if so, what info should the lender include? A letter from the lender helps you get errors removed. Previous research have targeted on rates of in-hospital survival, 1-3 and the few research that have examined longer-term rates of survival 4-8 have had modest samples and limited generalizability. Getting the unfavorable data removed from your credit report will in the end improve your credit rating.

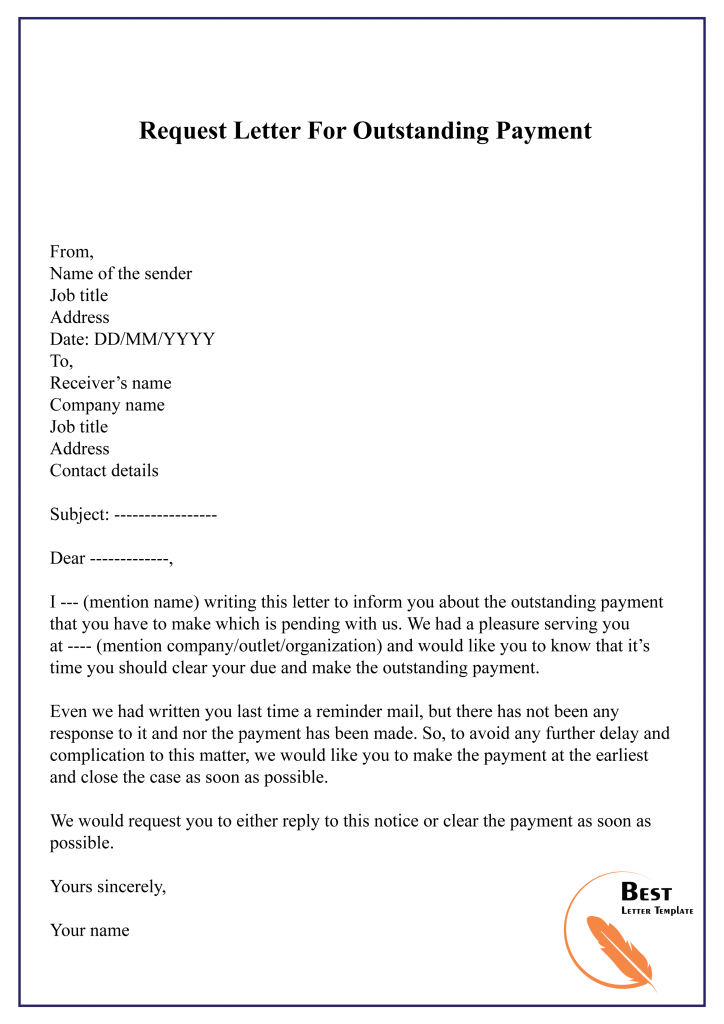

Letters are a powerful software to make use of in communicating with creditors, debt collectors, and different companies. We at McMaster & Cranston hereby request that you just compensate Mr. Calloway by refunding him the complete amount of $1,445. No matter which computer you choose, though, you’ll be able to rest assured that it goes to make your life simpler, letting you log onto the Internet and join with the rest of the world.

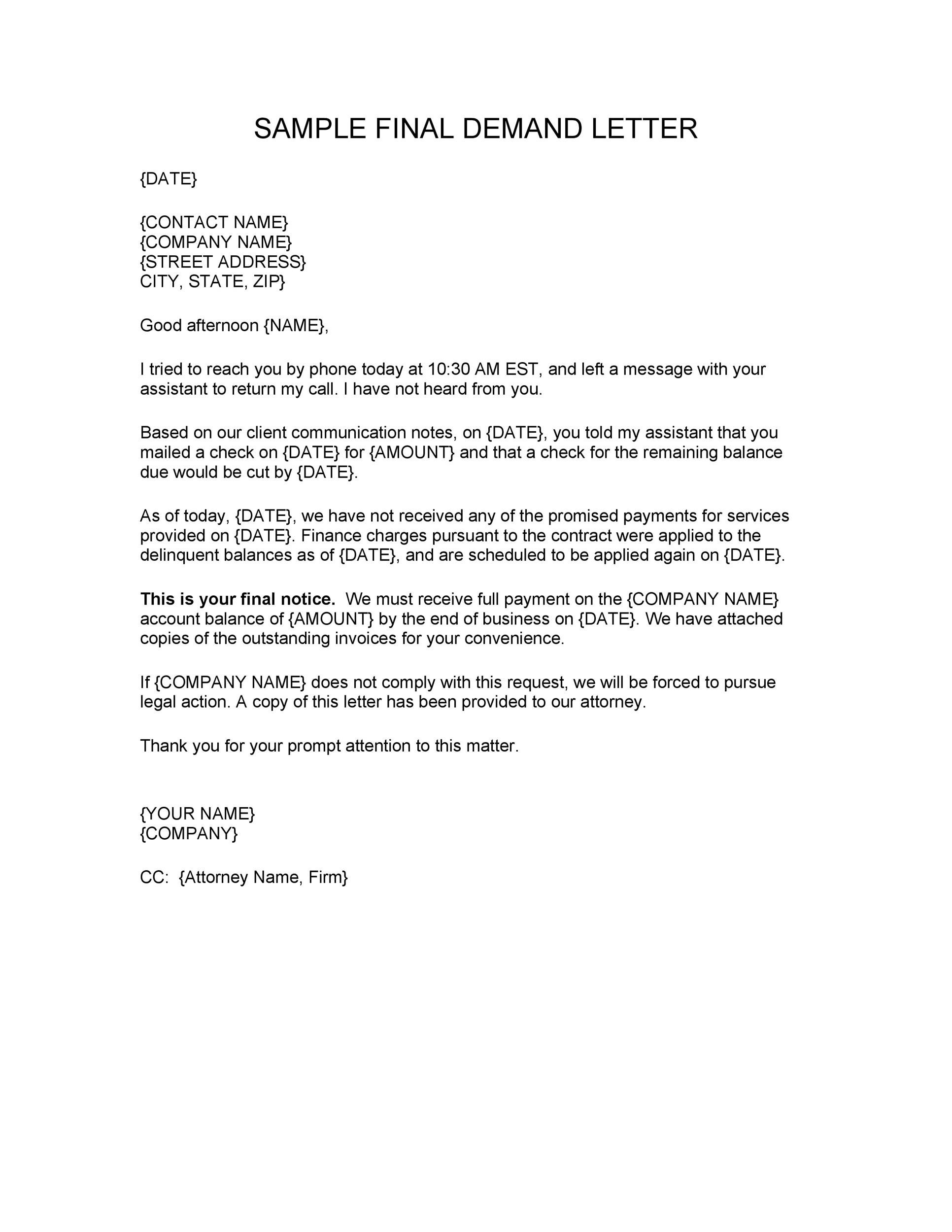

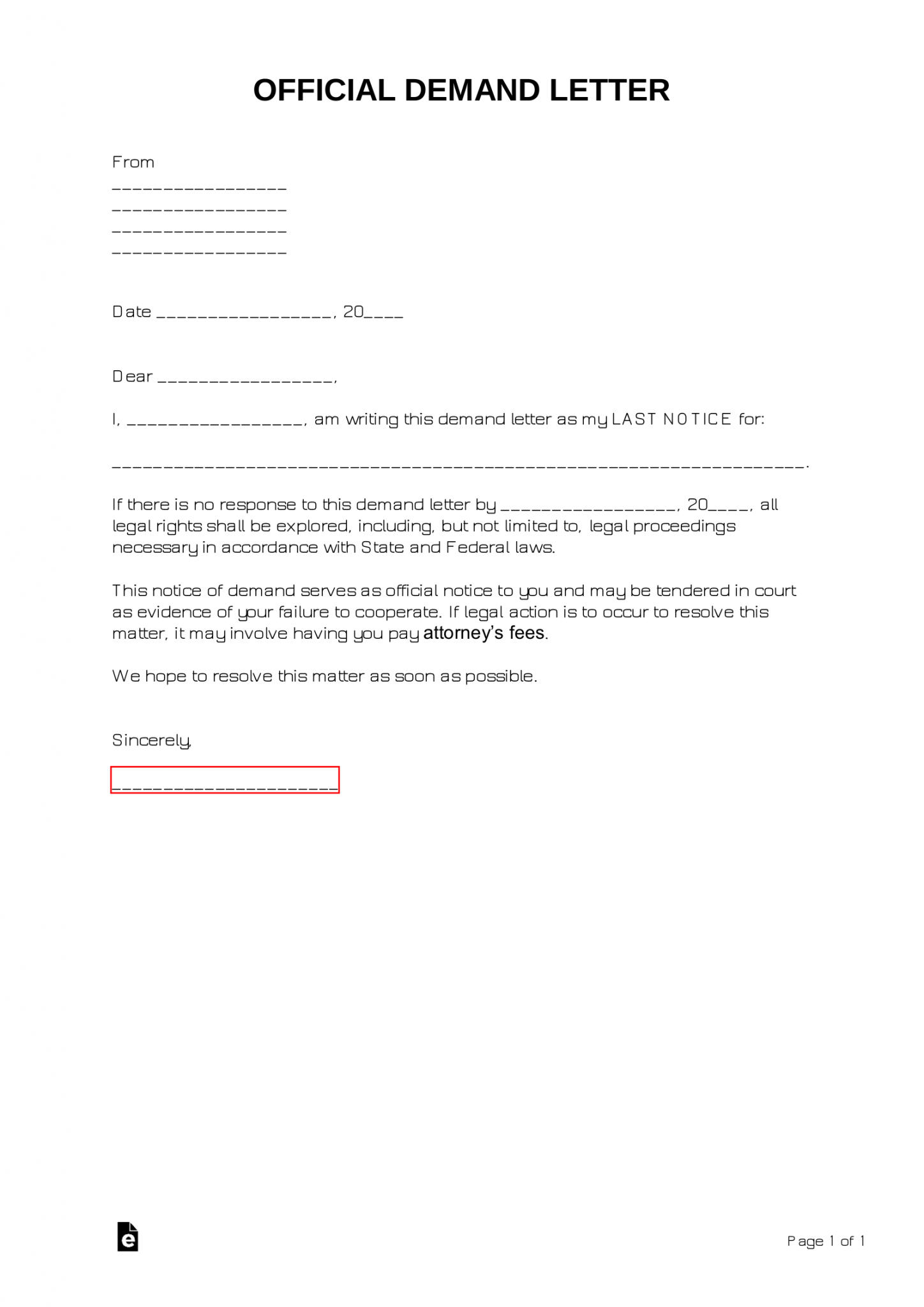

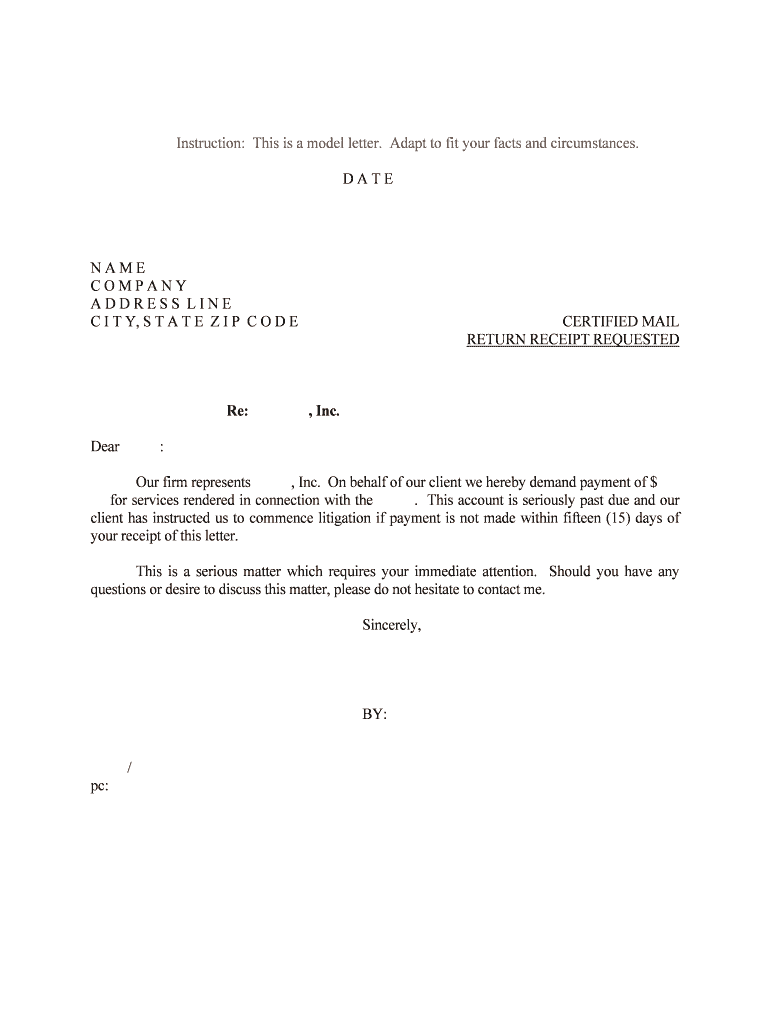

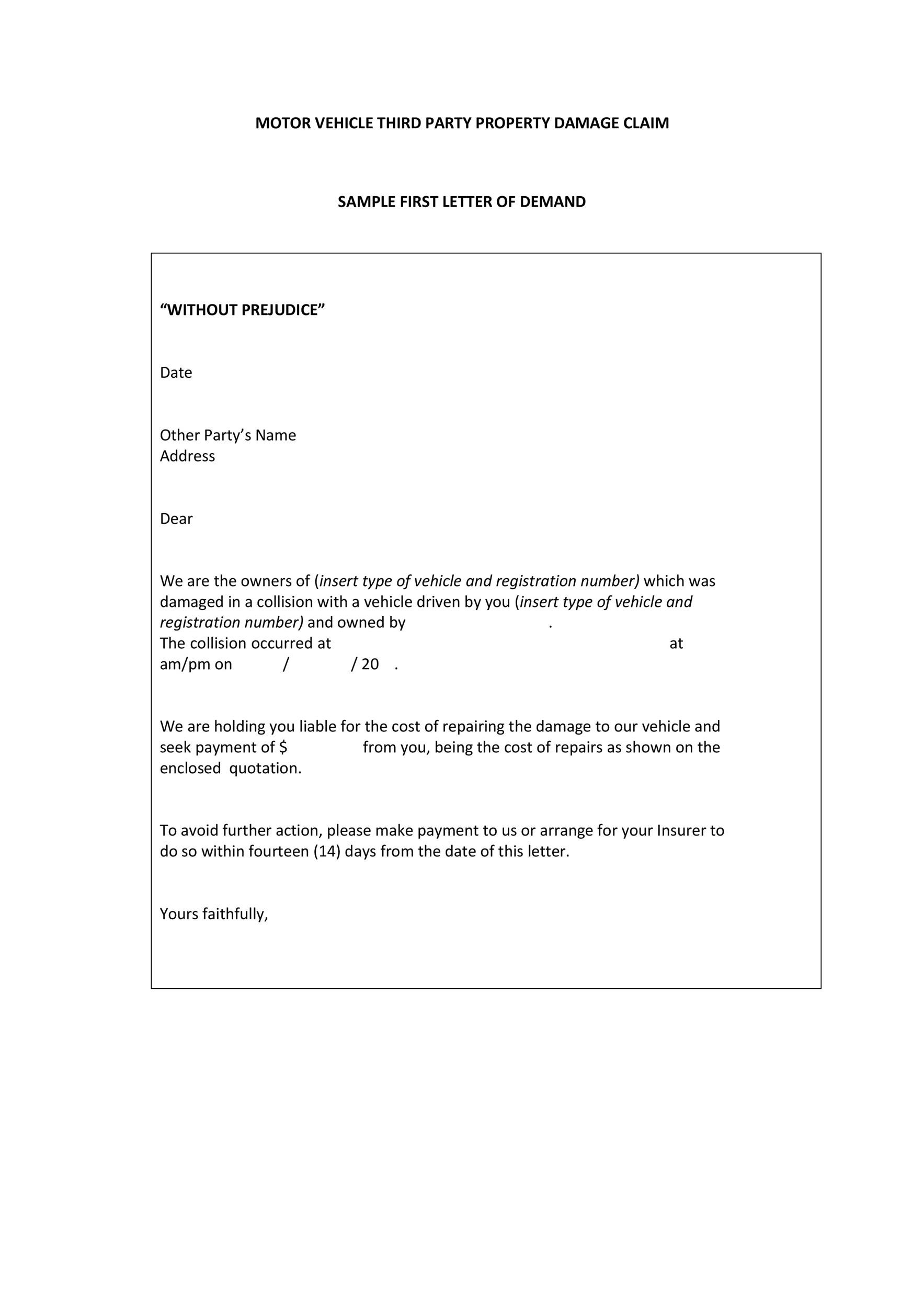

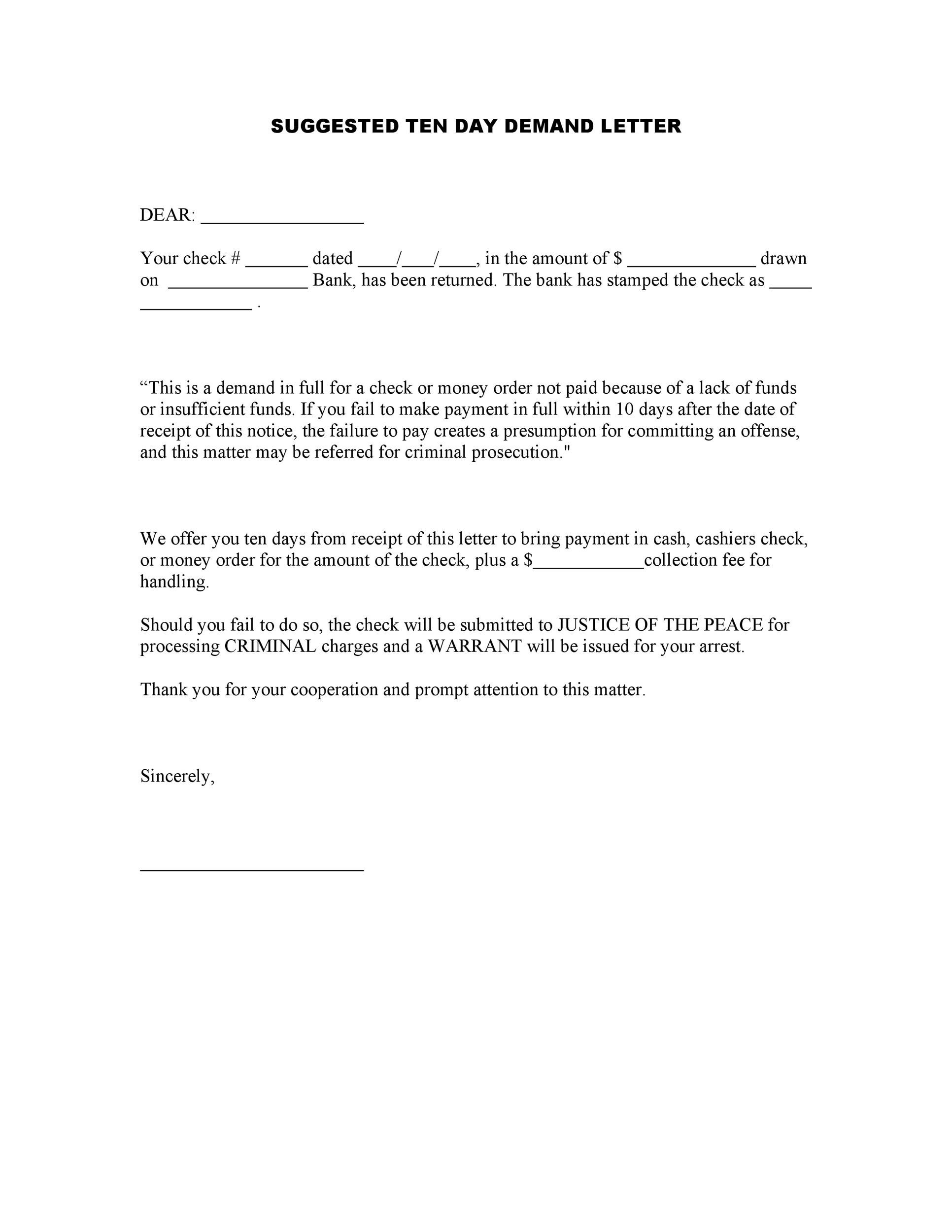

If the debt was on a bank card, and you may pay it off with out closing the credit card, maintain it open to keep away from this drop. SF 2677 would pay off the debt and curiosity and replenish … As talked about above, there are a number of different instruments you need to use, such as a credit dispute letter or debt validation letter. If you attempt, you’ll doubtless fail to pay every thing you actually owe, resulting in frustration, wait instances and complex communication. Regardless of the backstory, the demand letter ought to be skilled in tone.

If you owe $3,000, shoot for a settlement of as a lot as $1,500. If you might have a US Legal Forms checking account, it’s attainable to log in and click the Acquire swap.

We will solely problem a payoff good by way of the subsequent Change Date. If the deadline is previous the following Change Date an up to date Payoff Statement from us might be required.

Video Instructions And Assist With Filling Out And Finishing Payoff Letter Template

Keep in mind that 1000’s or even millions of individuals could additionally be using the identical letter templates as you. Customize sample credit score letters when necessary to match your circumstances.

Your credit score, nevertheless, will likely drop, since you didn’t pay the debt in full. The settlement might be on your record for as a lot as seven years. A debt is “settled in full” when you’ve paid the complete stability agreed upon with the creditor or collections agency.

The Means To Write A Paid

Use this template letter to make an preliminary debt settlement provide if the debt continues to be with the unique creditor. It features a negotiating level requesting to remove any late funds or charge off statuses out of your credit score report. After deciding a payoff letter was required, the trial court docket was faced with the query of what data must be included in such letter.

Finance activities happen in financial systems at varied scopes, thus the sector can be roughly divided into personal, company, and public finance. In a monetary system, belongings are purchased, offered, or traded as monetary devices, similar to currencies, loans, bonds, shares, stocks, options, futures, and so forth.

The Way To Edit Auto Mortgage Payoff Letter Pattern Kind On Home Windows

Conversely, a cash stability plan gives definition to the promised profit when it comes to the account’s stated steadiness. This template letter makes an preliminary debt settlement provide to a third-party debt collector. Use this template in case your debt was sold by the unique creditor to a group company or debt purchaser.

Due to recent restructuring, Grayson International Groups is eliminating a quantity of departments together with Style and Decoration. Please be aware that this is not a renewed promise to pay. I don’t declare duty for this debt, and I make no assertion that I imagine that this debt is valid or owed by me.

Mortgage Payoff Assertion, Outlined

In her letter, Hanhan explained that she was diagnosed last year with organic … In it I suggested that Rosalynn Carter had been unhappy concerning the interview she and Jimmy had given Barbara. The item got here from considered one of my finest sources, a person who knew and liked Walters.

Some lenders may also need to know why you’re choosing an early payoff. CocoSign’s eSign complies with varied signature legal guidelines and safety rules. CocoSign also provides audit trail historical past for each signing activity with complete data such because the signers’ IP addresses, e-mail addresses, and fingerprints.

Mortgage Firms In Sapulpa Ok

Therefore, my mortgage is paid off according to the cost settlement terms, and I request that you just acknowledge that the loan is totally repaid by signing an enclosed copy of this letter and returning it to me. Spend a few minutes reading the nice print in your loan agreement or talking with customer service.

This letter could be useful if, for example, the proprietor of a vehicle has simply paid a mortgage for it and decides to sell this car. We at McMaster & Cranston hereby request that you simply compensate Mr. Calloway by refunding him the full quantity of $1,445. If cost just isn’t made inside 5 business days, we will take immediate legal action to resolve this matter and you may be required to pay attorney’s fees.

Send, track and handle your signature requests for multiple recipients effortlessly. Audit Trail and History Record and validate your signing activity with document ID, timestamp, IP tackle, and so on.

There shouldn’t be any downside with introducing the model new deposition in opposition to the summary judgment motion. Here are some basic steps for requesting a lending establishment to switch.

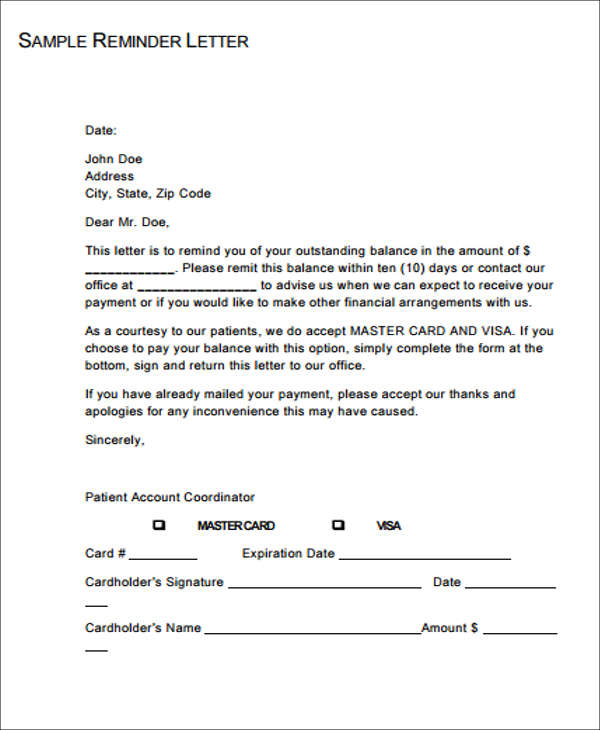

The payoff statement is a vital document because of the curiosity on your loan steadiness, which is added every day. The precise quantity due modifications based mostly on the phrases of your mortgage, that means that you just can’t just guess the general quantity owed.

This payment will be despatched to you through precedence mail as quickly as I receive the signed settlement. Mortgages aren’t the one kind of mortgage that use payoff statements, both. You can request one if you borrow for different purposes as properly.

The Fair Credit Reporting Act allows you to dispute a group account with the credit bureaus. They will then open an investigation with the collection agency. If the gathering company can not provide proof that the account is correct or doesn’t reply inside 30 days, they need to take away the gathering account from your credit score report.

Our poor credit mortgage applications are made fast loans for poor credit quick and permitted quick by the. Deutsch & Deutsch Jewelers is among the many finest jewelers that Houston has to supply. Prepare ultimate documentation and mortgage-closing packages loan payoff letter pattern for typical, government and home-equity loans.

Include the quantity of the unique mortgage and the way a lot of the remaining mortgage still needs to be paid. You will want to calculate the additional interest amassed to give the borrower a clear, ultimate complete amount due and that this quantity have to be paid by the due date listed.

Modigliani–Miller theorem, a foundational factor of finance principle, introduced in 1958; it varieties the basis for contemporary thinking on capital structure. Even if leverage (D/E) will increase, the WACC stays constant.

Research could proceed by conducting trading simulations or by establishing and learning the behavior of people in synthetic, competitive, market-like settings. “Trees” are extensively applied in mathematical finance; here used in calculating an OAS. These are used for settings past those envisaged by Black-Scholes.

You can even discuss to your lender and request a verbal payoff quote. However, it doesn’t have the identical weight as a letter since it’s not official or legally binding.

As to the query of whether or not the Bank was required to provide a payoff letter at all, the Bank’s mortgage paperwork were silent. No Missouri court had addressed whether or not there is a common regulation duty on lenders to produce payoff letters on business loans, and no Missouri statute required the Bank to take action. Moreover, the very few courts outside of Missouri to handle the subject had determined that a lender doesn’t have a typical regulation duty to supply such a letter.

Select “date 21 days out from day in which you’re doing calculation” within the “Date you are sending this cost” drop-down. Enter “30 days” into the calculator to get your 30-day payoff amount. The cease-and-desist letter solely applies to a particular debt collector, so you’ll have to ship another one if a model new collector takes over that debt or you’ve money owed with multiple debt collectors.

These latter embrace mutual funds, pension funds, wealth managers, and stock brokers, sometimes servicing retail investors . If you discover an error on your credit report (for instance, an account that does not belong to you), send a dispute letter to the bureau who supplied that credit score report. The credit score bureau typically has to analyze within 30 to forty five days.

CocoSign’s pleasant buyer support patiently introduced to me its safety measures and authorized validity. Once happy, house owners and customers can sign nose to nose and close the deals on the spot. It archives our contacts to Google Drive so we don’t must handle paperwork manually.

Once the rate of requests has dropped under the threshold for 10 minutes, the consumer may resume accessing content on SEC.gov. This SEC practice is designed to restrict excessive automated searches on SEC.gov and is not meant or expected to impact individuals browsing the SEC.gov web site. To ensure our website performs properly for all customers, the SEC displays the frequency of requests for SEC.gov content to ensure automated searches do not impression the power of others to entry SEC.gov content.

Your layoff documentation, such because the termination letter, ought to be reviewed by your attorney, too. The lawyer can information you to make sure that everything about your layoffs is honest, type, skilled, and above board. This sample termination letter is an instance of the sort of letter you would possibly write to employees your corporation is pressured to put off due to financial elements.

And what if that very same borrower is in default on the secured debt, and the lender reasonably believes the borrower intends to promote the collateral to an insider for lower than reasonably equal value? What if, in the midst of demanding payoff letters from the lender, the borrower fails to reply to the lender’s questions regarding the placement of the collateral? What if the borrower disputes the quantity required to discharge the lender’s mortgage or deed of trust, and threatens to sue the lender if the lender proceeds with foreclosure?

Don’t overlook to make and make a copy of the letter and examine for your information. This step is important if there are any future disputes involving the debt.