Full And Final Settlement Agreement Template. A nationwide political pact from the regions and with all political parties and movements, unions, civil society and all other major participants within the civic lifetime of Colombia rejecting using arms in politics or the promotion of violent organizations like paramilitarism. In March, a delegation of six members of Congress travelled to Havana to meet with the FARC negotiators and the encounter was described as productive and respectful. With the intention that there have been no more agreements with out the gender perspective, on the end of October 2013 took place in Bogotá the National Summit of Women for Peace, the place was a national agenda consolidated, the place around 500 girls from 30 of the 32 departments representations. The dying of the eleven soldiers turned public opinion against the peace process and boosted the popularity of its main opponent, Álvaro Uribe.

This is recognized as a “tuition reduction.” You haven’t got to incorporate a qualified tuition discount in your earnings. Most jurisdictions have formulation for calculating what’s applicable, and many require courtroom approval. If larger, the actual quantity charged if the coed is residing in housing owned or operated by the eligible academic establishment.

The advance baby tax credit score payments had been early funds of up to 50% of the estimated baby tax credit score that taxpayers may properly claim on their 2021 returns. Because the scholarship Carey acquired was utilized to tuition , they don’t embrace that within the quantity they paid for certified tuition bills. Select the second definition to indicate that the Couple will agree to joint custody of all Children under their care. The amount contributed from the survivor advantages is handled as a part of your basis within the Coverdell ESA, and will not be taxed when distributed. When Aaron graduated from school in January last 12 months, he had $5,000 left in his QTP.

Generally, you probably can claim the American opportunity credit if all three of the following requirements are met. Don’t claim the American opportunity credit score for 2 years after there was a last determination that your declare was because of reckless or intentional disregard of the rules, or 10 years after there was a final willpower that your claim was due to fraud..

The particulars of the settlement on authorized safety sparked authorized controversy in Colombia. Álvaro Uribe known as it a coup d’état, whereas Inspector General Alejandro Ordóñez, one other major critic of the peace course of, wrote a letter to Santos in which he accused him of wishing to replacing the Constitution in tandem with the FARC and threatened him with disciplinary action.

Generally, should you take a distribution out of your IRA before you reach age 59½, you must pay a 10% further tax on the early distribution. This applies to any IRA you personal, whether it’s a conventional IRA (including a SEP-IRA), a Roth IRA, or a SIMPLE IRA. The further tax on an early distribution from a SIMPLE IRA may be as high as 25%. 560, Retirement Plans for Small Business, for information on SEP-IRAs, and Pub.

Xxxvi Further Phrases & Circumstances

Your foundation is the whole amount of contributions to that QTP account. Of his $5,800 of qualified higher schooling bills, $4,000 was tuition and related bills that additionally certified for an American opportunity credit.

As shown in the following record, to be certified, a variety of the expenses must be required by the college and some must be incurred by college students who are enrolled a minimal of half-time. A Coverdell ESA is a trust or custodial account created or organized in the United States just for the purpose of paying the qualified education expenses of the Designated beneficiary of the account.

Future Territorial Claims

Jefferson is a sophomore in University V’s diploma program in dentistry. Because the tools rental is needed for his course of examine, Jefferson’s equipment rental payment is a qualified expense. Your modified adjusted gross revenue is $90,000 or extra ($180,000 or more if married filing jointly).

The entire concept is to avoid any risk of disputes over what Husband and Wife are talking about right here, and what each is answerable for. Even separate bank accounts may must be included, depending on the legal guidelines of your state.

In figuring the amount of either education credit , Joan should reduce her qualified education expenses by the amount of the scholarship ($2,000) as a result of she excluded the whole scholarship from her earnings. The scholar loan isn’t tax-free educational help, so she doesn’t need to reduce back her qualified expenses by any a part of the mortgage proceeds.

The Role Of The International Community

If you are a person with a incapacity and can itemize your deductions, you deduct your impairment-related education expenses as an itemized deduction. An itemized deduction reduces the amount of your revenue topic to tax.

When it comes time to go your separate methods, somebody has to take responsibility in your debt. To assist you to understand what’s concerned in getting divorced in California, the process has been damaged down into 10 fundamental steps.

Full And Ultimate Settlement Provide Sole Name

Within the federal government, the thought of imposing a deadline for an settlement grew in recognition, supported by Vice President Germán Vargas Lleras and even by strong supporters of the peace process like senator Horacio Serpa and interior minister Juan Fernando Cristo. President Santos additionally mentioned the thought in a speech on April 17. On November sixteen, the FARC kidnapped General Rubén Darío Alzate, commander of the Joint Task Force Titán; Alzate was the first common to be captured by the guerrilla within the history of the armed battle.

Carey enrolled full time as a freshman on the identical school in January 2021 to start engaged on her bachelor’s diploma. Go to IRS.gov/Notices to search out further details about responding to an IRS notice or letter.

You haven’t got to make use of the tuition reduction at the eligible academic institution from which you acquired it. In other words, if you work for an eligible academic institution and the establishment arranges so that you simply can take courses at one other eligible educational institution with out paying any tuition, you may not have to include the worth of the free programs in your earnings. Even though the same time period, such as qualified education bills, is used to label a basic component of lots of the education benefits, the same bills aren’t essentially allowed for each profit.

For purposes of QTPs, the expenses may be both certified higher schooling expenses or qualified elementary and secondary training bills. The bills can be either qualified higher training expenses or certified elementary and secondary schooling bills.

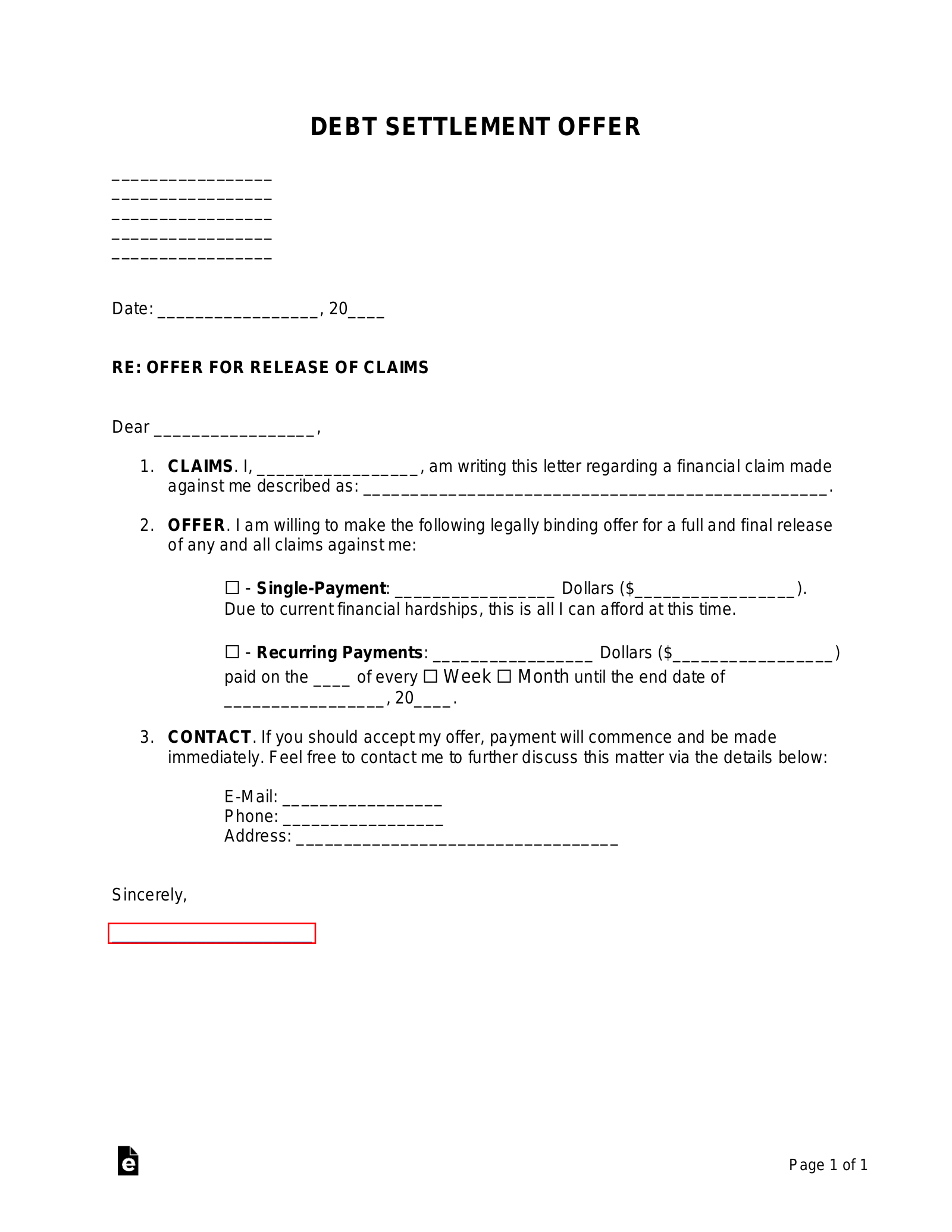

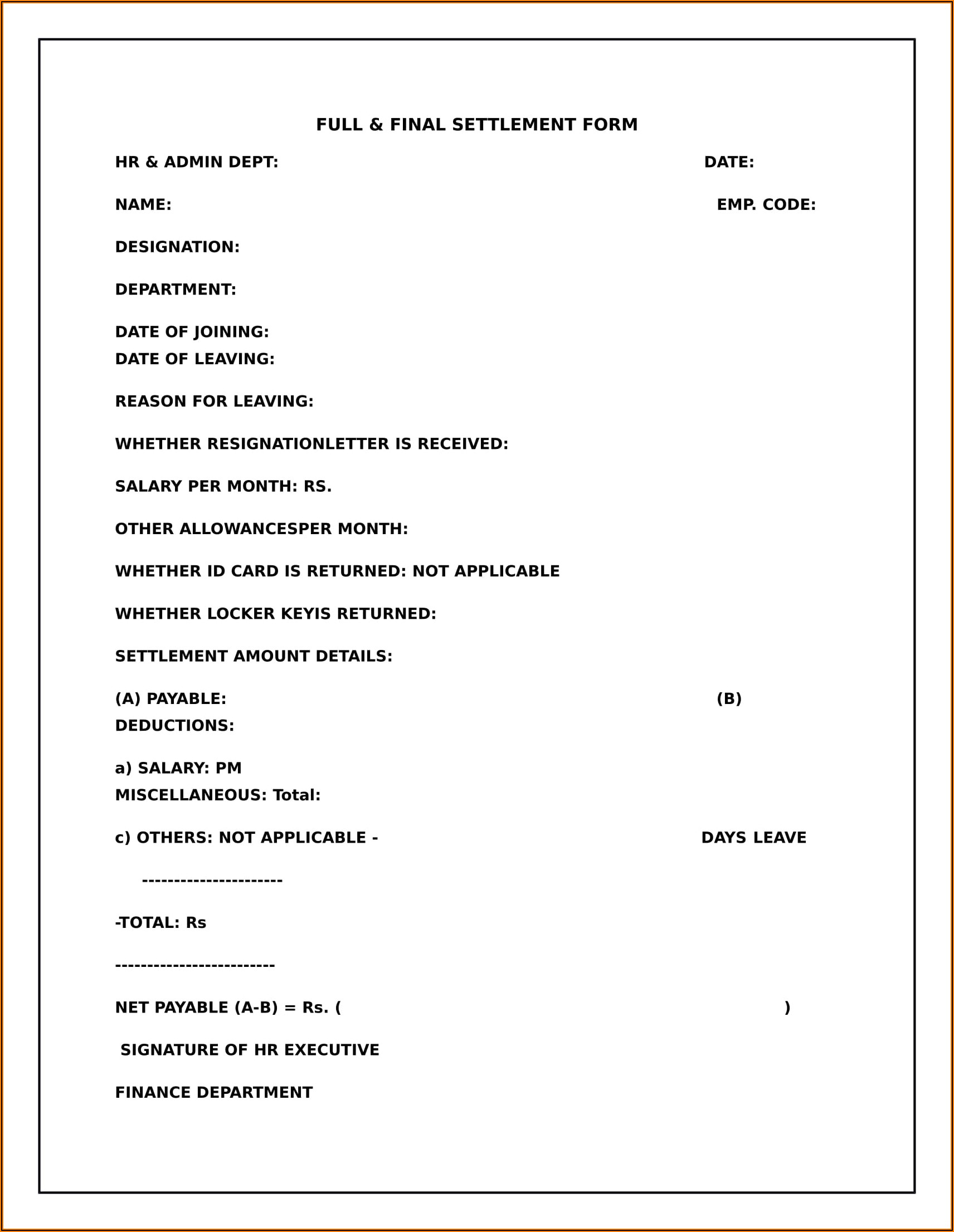

List every debt the Wife will be held liable for after this agreement is executed. Select either “Husband” or “Wife” from the primary set of checkboxes in this selection to ascertain who the Paying Spouse is then select one of the last two checkboxes to document who the Receiving Spouse is. Define all property this settlement requires the Wife to have possession of once it’s signed.

This is unpaid curiosity on a student loan that is added by the lender to the outstanding principal balance of the mortgage. Capitalized interest is handled as interest for tax purposes and is deductible as payments of principal are made on the loan.

You cannot use any quantity you paid in 2020 or 2022 to figure the certified training bills you employ to figure your 2021 schooling credit.. The academic establishment ought to be in a position to tell you whether it is an eligible educational institution..

It built on the reality fee, the September 23 settlement on the Special Jurisdiction for Peace, in addition to the October bulletins on the search unit for disappeared persons. In the first spherical, Zuluaga did nicely with a first-place end (29.28%) forward of President Santos (25.72%).

In September 2014, a devoted gender Subcommittee was established on the talks, mandated to guarantee that a gender perspective and women’s rights are included in all agreements. With the intention that there were no more agreements with out the gender perspective, on the end of October 2013 occurred in Bogotá the National Summit of Women for Peace, the place was a national agenda consolidated, where around 500 girls from 30 of the 32 departments representations. With the motto “las mujeres no queremos ser pactadas, sino ser pactantes” ,” the 800 proposals that have been constructed were given to the government delegation.

A personal schooling loan does not embody an extension of credit score beneath an open finish consumer credit score plan, a reverse mortgage transaction, a residential mortgage transaction, or any other loan that’s secured by real property or a dwelling. Donna and Charles, both first-year college students at College W, are required to have certain books and different studying materials to use of their obligatory first-year lessons.

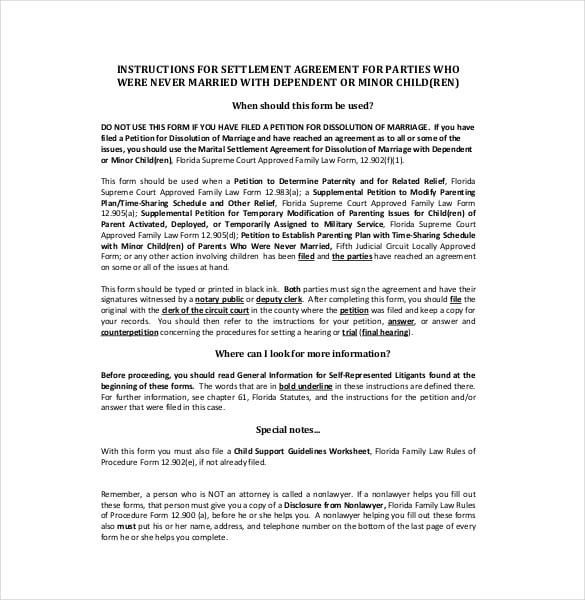

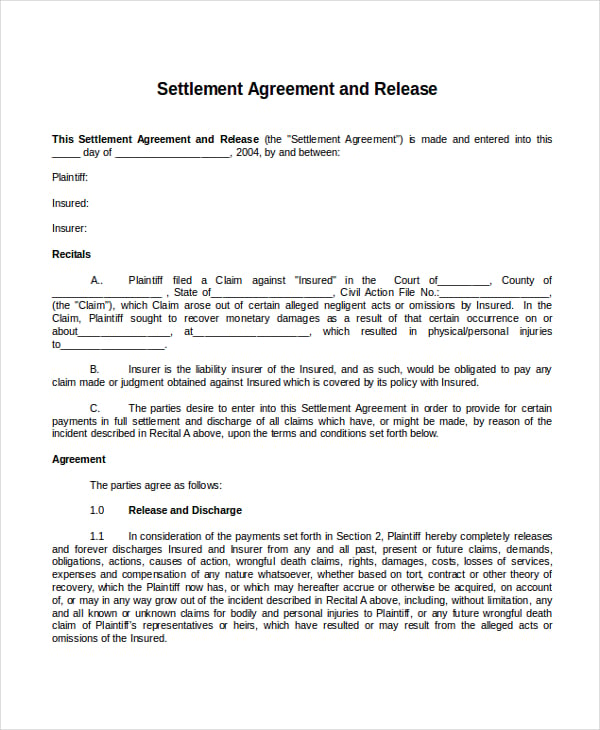

Post Nuptial Financial Agreement – Full and Final Settlement – The agreement units out how the ownership of the cohabitation property is to be transferred, the tax arrangement and in addition releasing one another’s proper to make an utility in relation to the property of the other. Traffic Accident Full and Final Settlement Agreement (Neutral – No Personal Injury) – This template is drafted in neutral type i.e. both events affirm that no private damage is concerned within the accident and neither party will make a complaint to the Police. As the name suggests, the aim of the settlement is to settle the dispute once and for all with out the need to begin legal proceedings in court.

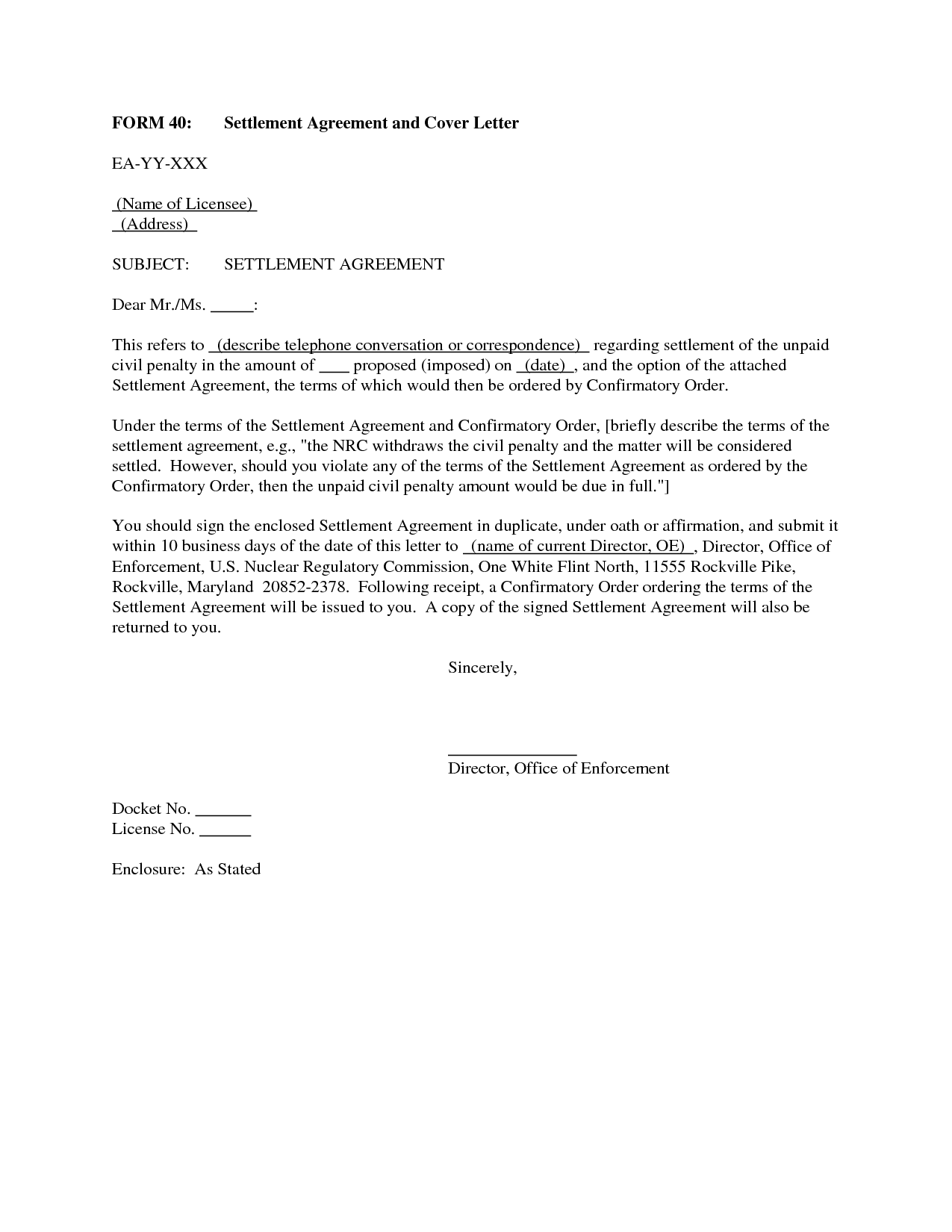

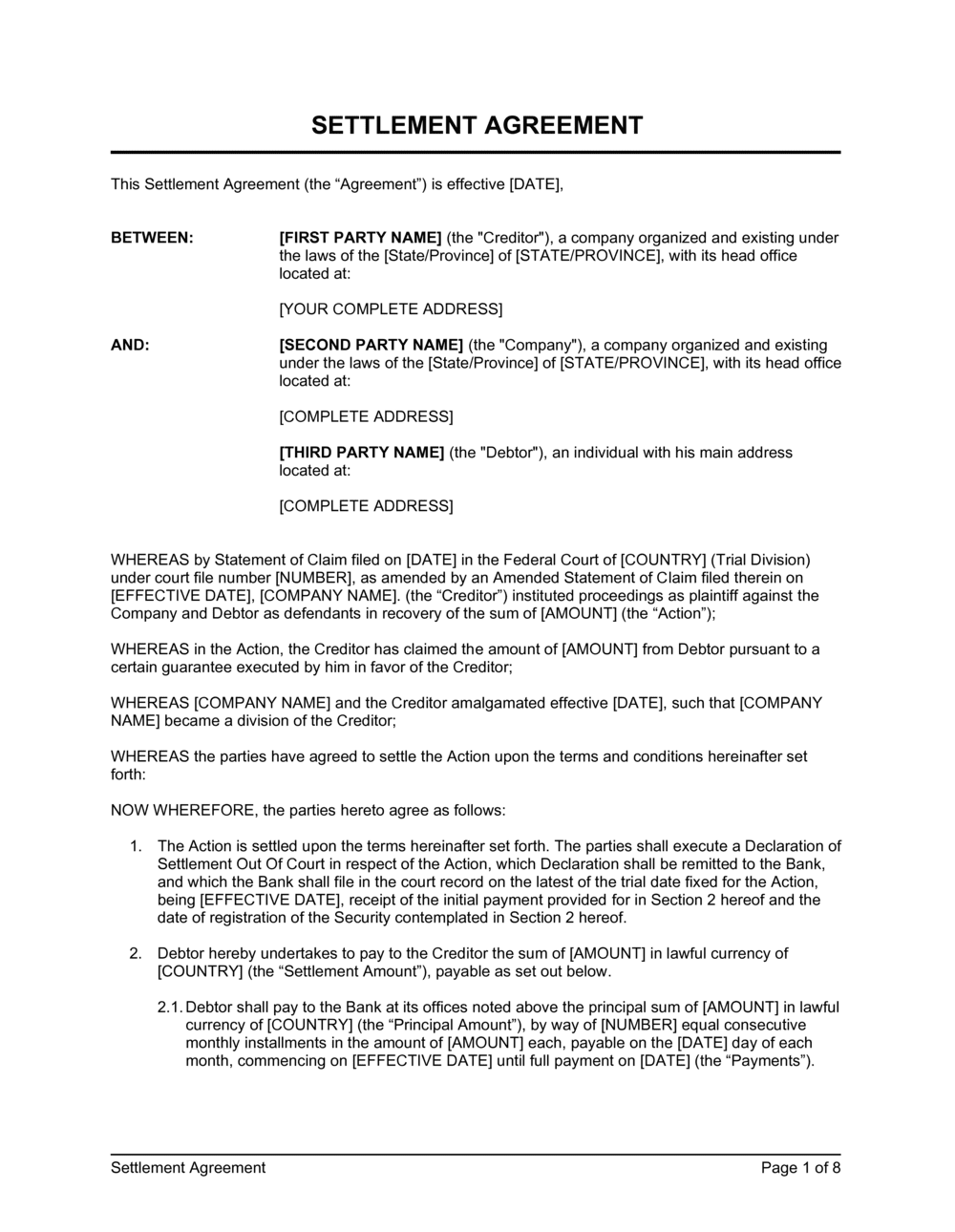

First, the doc outlines the entire pertinent figuring out particulars, such as the Parties’ respective addresses, contact data, and names of legal representatives . It wouldn’t have made any sense for the parties to conclude a settlement agreement that solely purported to regulate any future relationship between them. Any obligations created had been extinguished by the settlement agreement.

If any tax-free instructional assistance for the certified schooling expenses paid in 2021 or any refund of your qualified training expenses paid in 2021 is obtained after you file your 2021 revenue tax return, you must recapture any extra credit score. You do that by refiguring the amount of your adjusted qualified education expenses for 2021 by lowering the bills by the amount of the refund or tax-free educational help.

If the taxable quantity was not reported on Form W-2, additionally enter “SCH” and the taxable amount on the dotted line next to line 1. This contains such companies and lodging as room , board , laundry service, and similar services or accommodations which would possibly be acquired by a person as a part of a scholarship or fellowship grant. Many forms of instructional help are tax free in the event that they meet the necessities mentioned here.

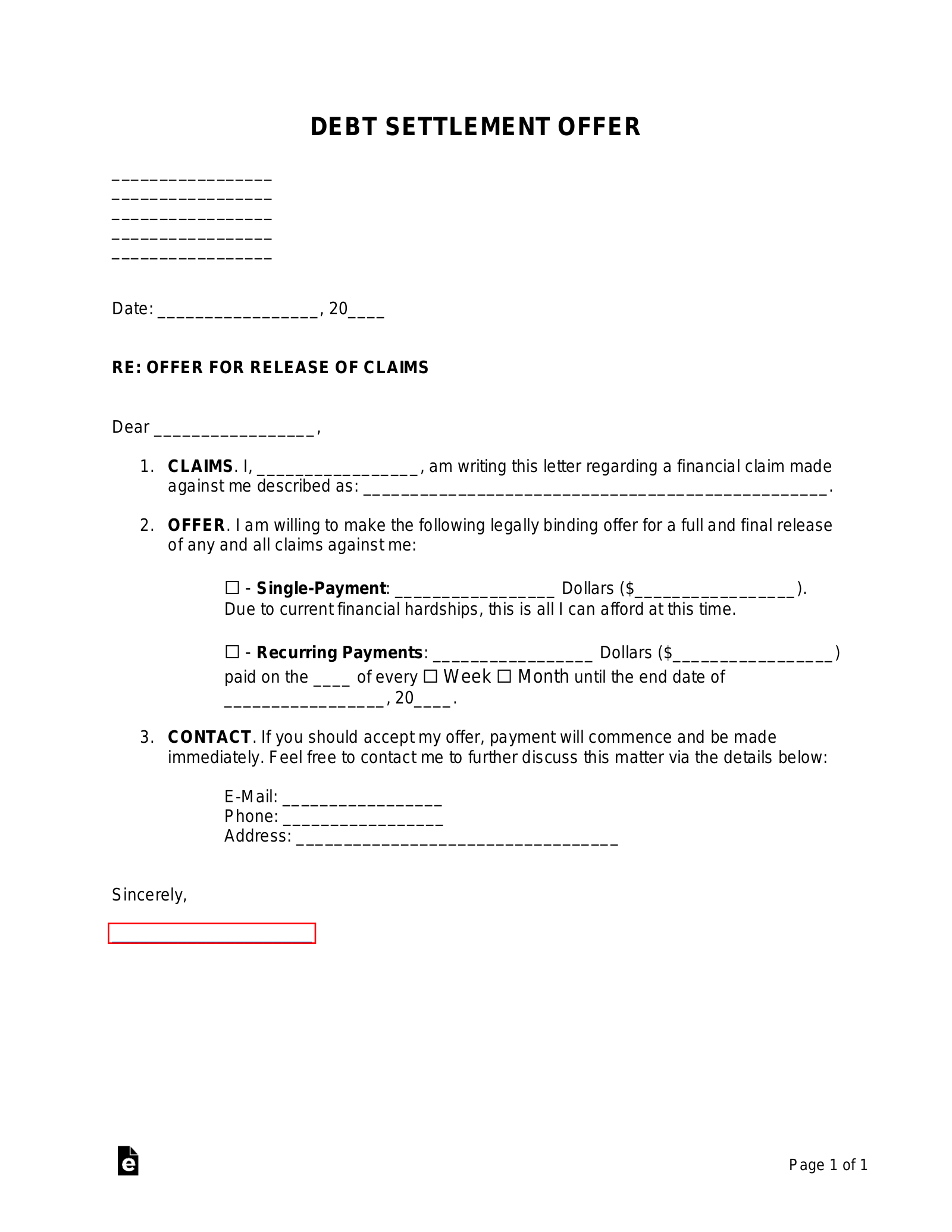

The debtor should watch out for nice print and punctiliously review any correspondence, proposed settlement or settlement with a creditor. Settlement agreements should be reviewed rigorously, perhaps by a 3rd celebration, to be sure that all of the phrases are these that are agreed upon. Settling one’s debt can be an emotionally draining and tough process.

Ten years after the 2010 World Cup the Supreme Court of Appeal has given judgment in a dispute between the South African Football Association and a travel business referring to travel arrangements for the competition. The parties had a settlement agreement which was in ‘full and last settlement’ of the dispute relating as to whether SAFA had to offer air tickets to Fli-Afrika to enable it to e-book accommodation and associated preparations.

If one Spouse should help the other with a payment schedule that can’t be defined by any of the above selections, then choose the ultimate checkbox statement. Attachment B of this doc can then be used to dictate the cost schedule and amount this agreement will impose. If the help payment might be required regularly indefinitely once the divorce happens, then select the “In Perpetuity” checkbox, record the support cost quantity, and document the two-digit calendar day of each month when will probably be due.

This settlement should handle the subject of Children under the Couple’s care. First, select both the first checkbox to point this Couple has Children or the second checkbox to ascertain this Couple has no Children.

Claim a lifetime studying credit score based mostly on the same expenses used to determine the tax-free portion of a distribution from a Coverdell education savings account or certified tuition program . See Coordination With American Opportunity and Lifetime Learning Credits in chapter 6 and Coordination With American Opportunity and Lifetime Learning Credits in chapter 7.

To declare the American alternative credit score, the scholar for whom you pay certified schooling bills have to be an eligible student. Because Joan reported the whole $2,000 scholarship in her revenue, she does not want to scale back her certified schooling bills. Joan is handled as having paid $3,000 in qualified education expenses.

Bill claims the standard deduction of $12,550, leading to taxable earnings of $22,500 and an revenue tax liability before credit of $2,504. Bill claims no credit other than the American opportunity credit score. He figures his American opportunity credit based mostly on certified training expenses of $4,000, which outcomes in a credit of $2,500 and a tax legal responsibility after credit of $4 ($2,504 − $2,500).

It was then attainable for all worldwide events to barter a final settlement. Finally, the document can embrace elective particulars in regards to the agreement, such as the Parties agreeing to chorus from suing each other or maintain the details of their settlement confidential. This doc contains all the needed details to place in writing the phrases of an agreement between a Debtor and Creditor to resolve a debt that is owed.