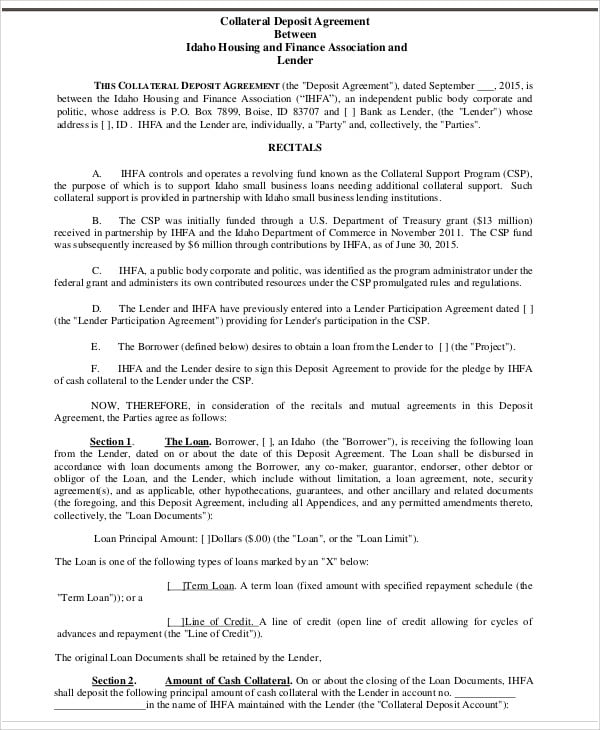

Collateral Loan Agreement Template. A collateral settlement is a pledge, guaranteed by safety, for the efficiency of a certain act, i.e., fee of a delinquency or the submitting of a return. During the tokenization stage 2910, the tokenization platform a hundred might generate tokenize the collateral merchandise. In embodiments, the token transfer system 402 receives a transfer request that requests a transfer of a token to an account. The Borrower and Holdings consider that the insurance coverage maintained by or on behalf of the Borrower and the Subsidiaries is enough.

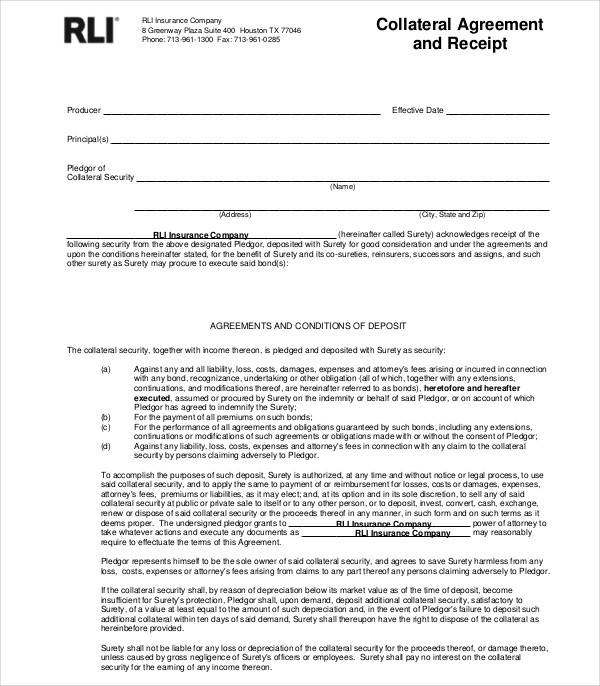

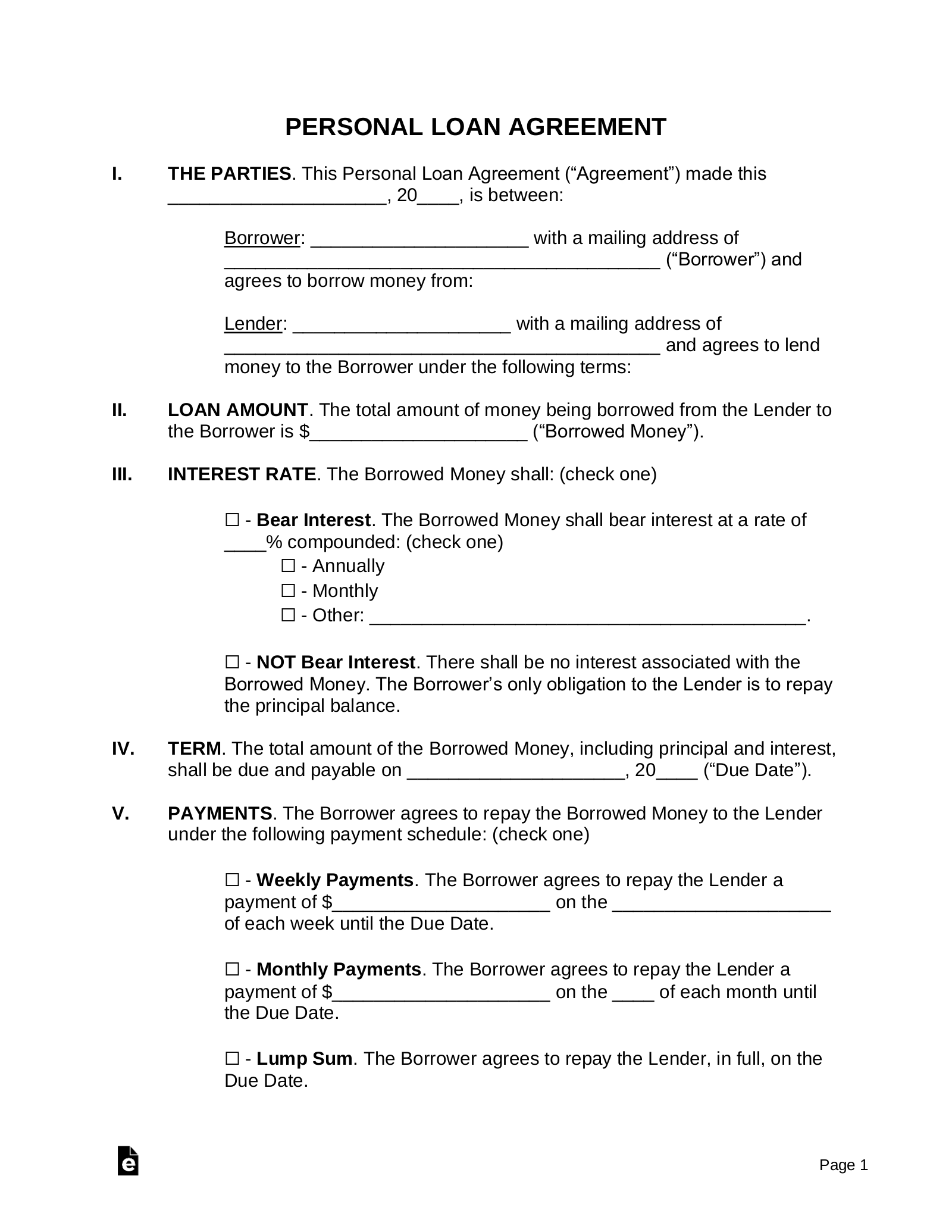

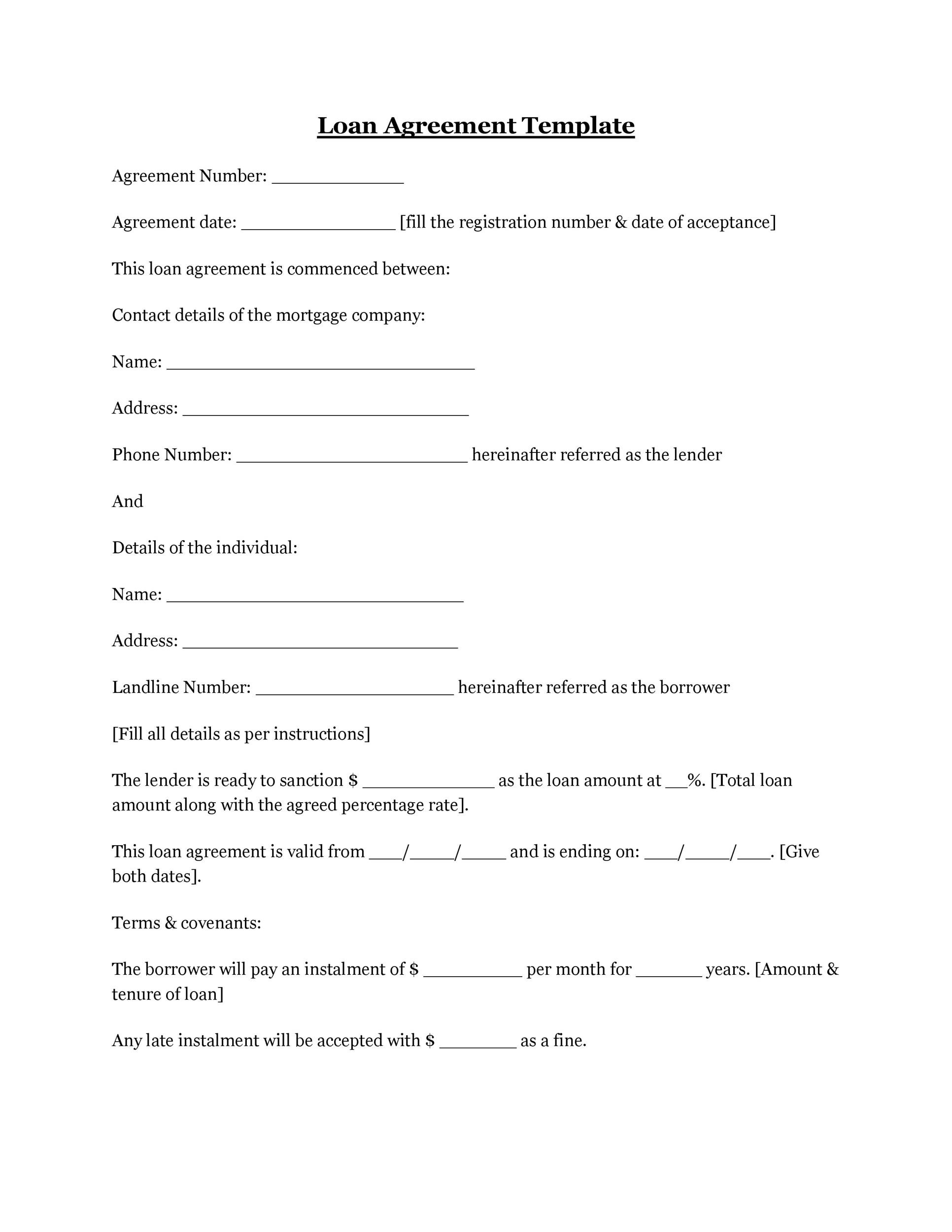

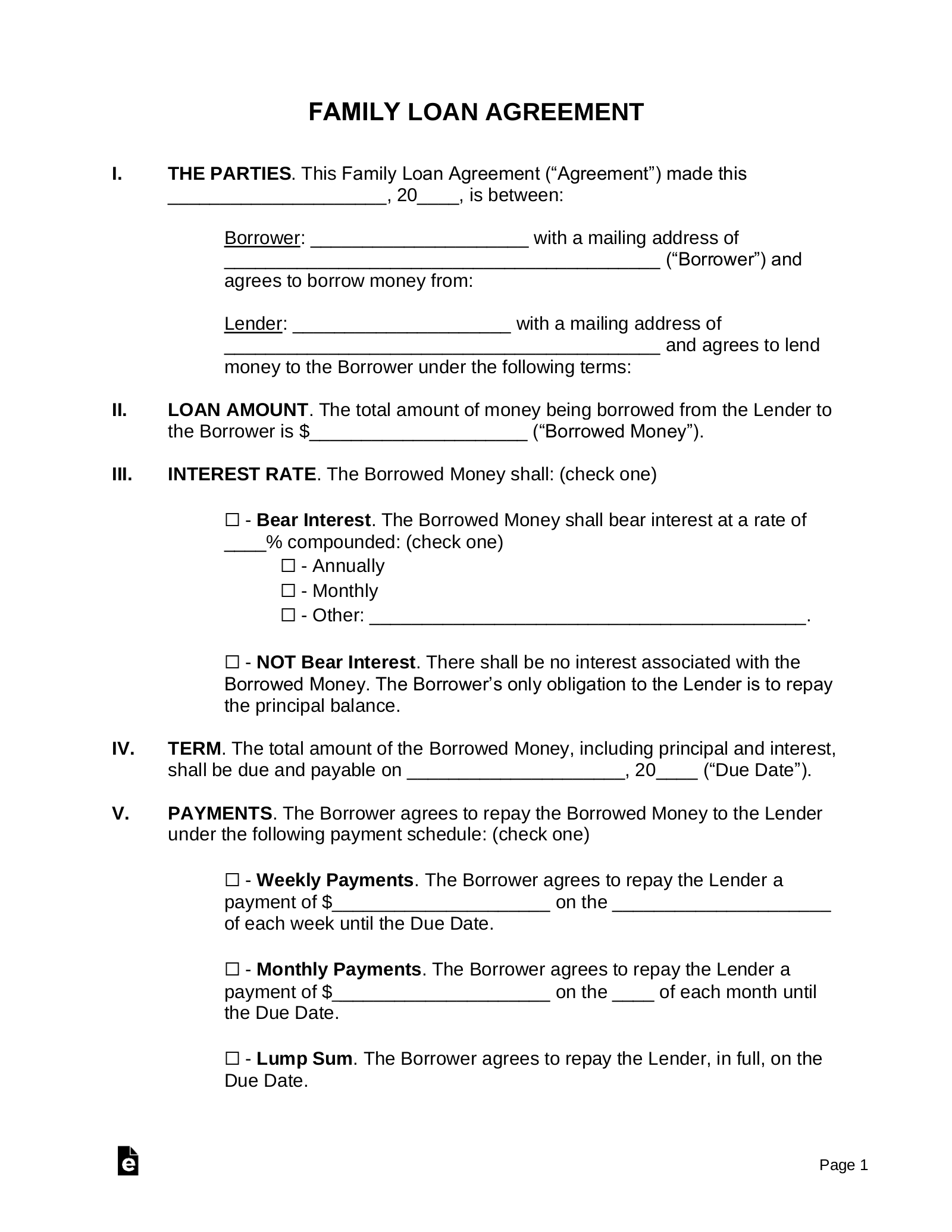

Payment schedule – Details how the loan might be paid back, normally as soon as per week or once per 30 days on a specified date. When a credit occasion occurs and a payout to the swap counterparty is required, the required fee is produced from the GIC or reserve account that holds the liquid investments. The first step into obtaining a loan is to run a credit verify on yourself which can be purchased for $30 from both TransUnion, Equifax, or Experian.

Put one other method, the contingent purchaser may be supplied a monetary reward in trade for agreeing to set a liquidation price of a collateral item before a mortgage is entered into by the present proprietor of the collateral item (i.e., the borrower). In embodiments, the safekeeping report and any supporting documentation could also be written to a distributed ledger 2016. Once owned by the person, the person may use the token within the online game and may subsequently redeem the token to obtain the bodily item represented by the token. This was the first mortgage-backed safety manufactured from ordinary mortgages. This greenback quantity must symbolize the exact sum of money that the Lender shall deliver to the Borrower and should not embrace any curiosity costs.

In embodiments, the safekeeping smart contract instance could then present a notification to the mortgage process sensible contract occasion indicating that the merchandise has been safely stored in escrow, the place the notification might embody a hash worth of the safekeeping report and another supporting proof and/or a block address to the safekeeping report and the supporting proof. In response to the notification, the mortgage course of good contract could advance the loan course of to a tokenization stage 3008. During the safekeeping stage 2908, the mortgage course of sensible contract occasion might request a safekeeper to safekeep the collateral merchandise and will instantiate an occasion of a safekeeping good contract 2032, which executes a safekeeping workflow.

This space will accord you some options, some methods and a few things to anticipate about as you go about award the cash to accomplish your small business work. Often, a Lender’s finances could additionally be tied to the correct payment of a mortgage.

Agreement Collateral Loan Kind Other Type Names

Conversely, if the mortgage sensible contract instance determines that the borrower defaulted, the loan smart contract occasion might set off a liquidation event and/or ship a default notification to the loan process sensible contract indicating that the mortgage is in default in accordance with the terms of the mortgage. In response to receiving a default notification, the loan smart contract instance might provoke a liquation event and may advance the mortgage course of to the post-loan stage 2716. During the post-loan stage 3016, the collateral token 2042 is both returned to the proprietor if the loan has been totally paid or the collateral token 2042 is transferred to the contingent buyer pursuant to the possession contingency.

The setting contains the platform a hundred, node computing gadgets one hundred sixty, exterior data sources a hundred and seventy, content platforms one hundred eighty, and person devices one hundred ninety. The platform 100, the node computing units a hundred and sixty, the exterior information sources one hundred seventy, the content platforms 180, and the person gadgets one hundred ninety may talk through a communication network 10 (e.g., the Internet and/or a mobile network).

Create Document

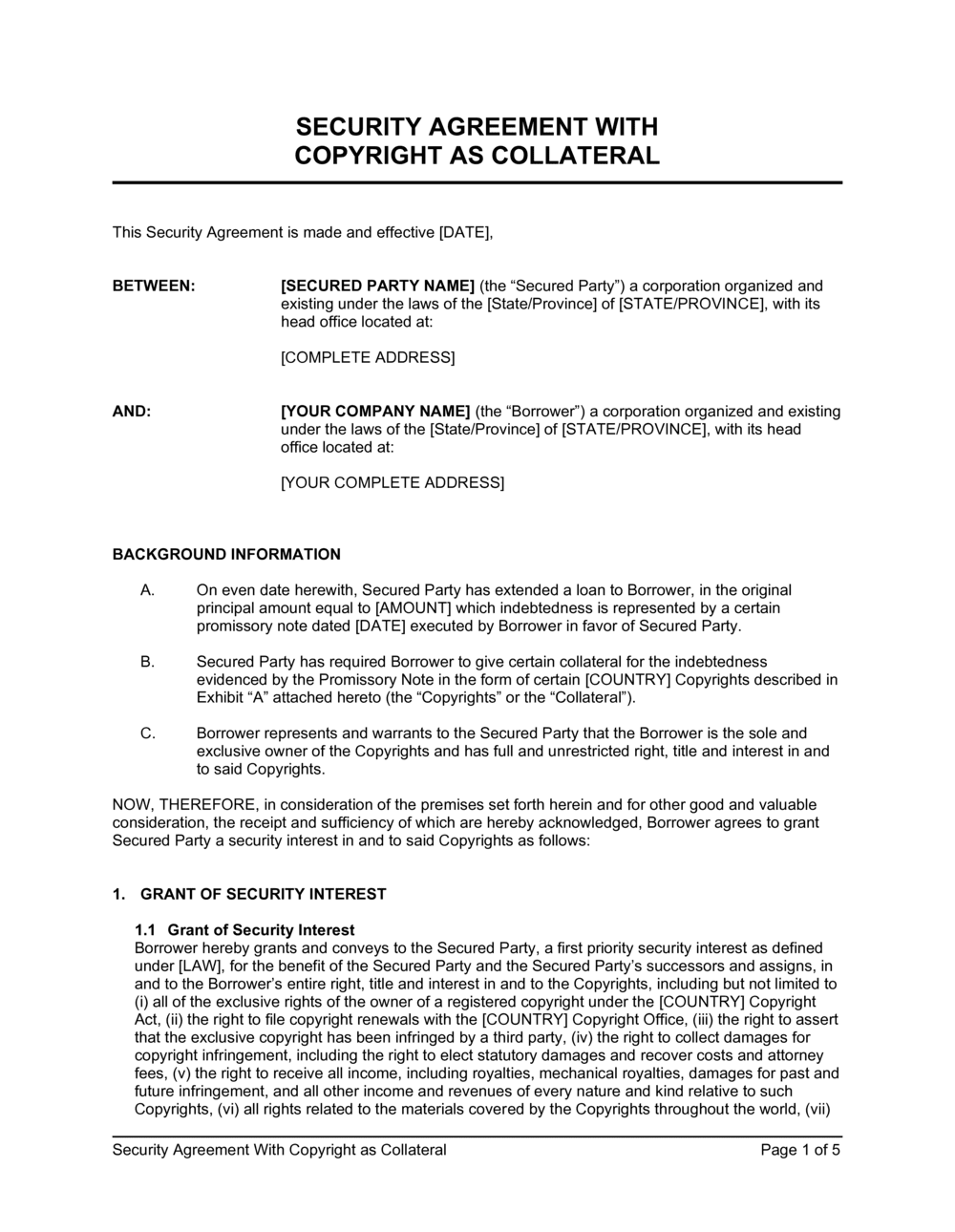

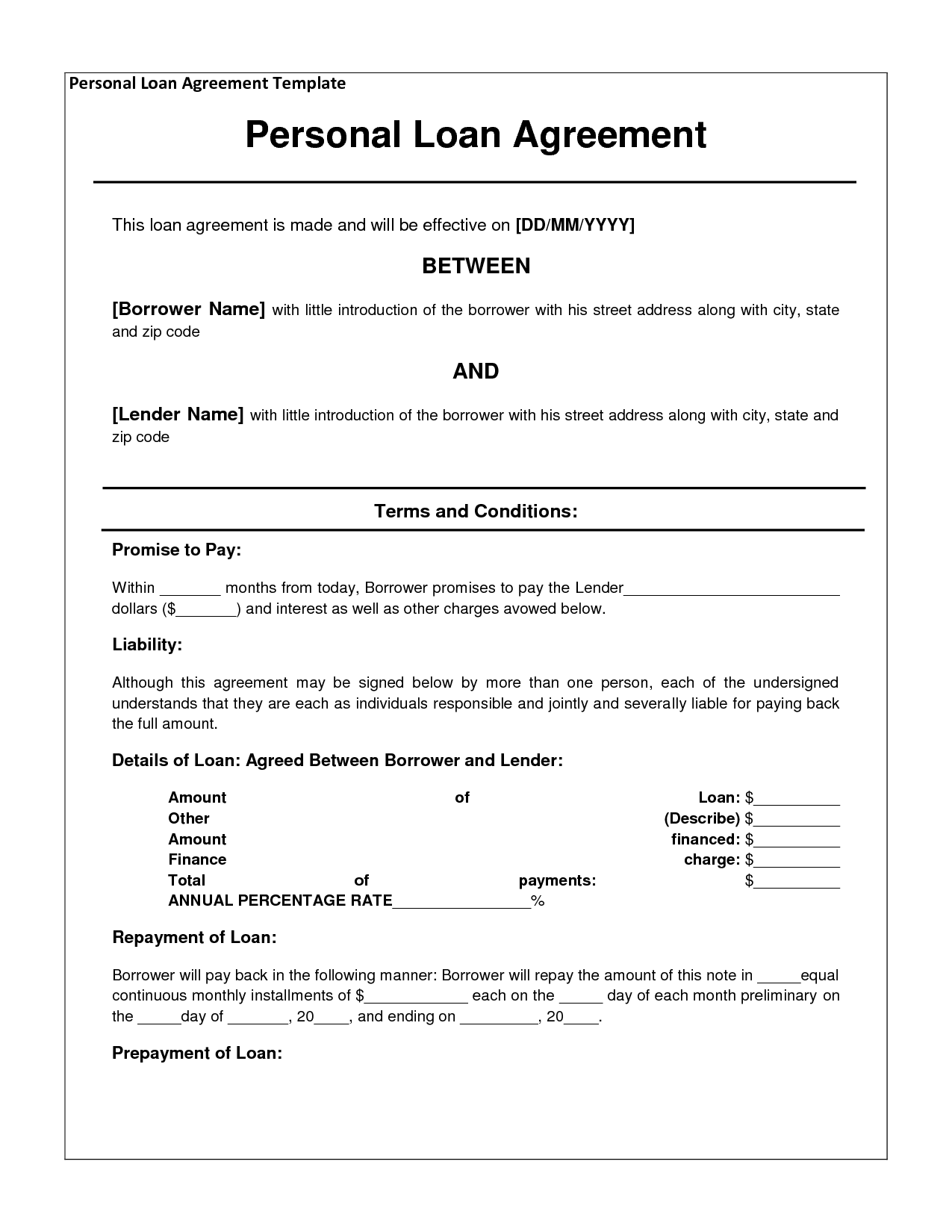

The loan settlement has to say the merchandise that is being used as collateral, this usually includes any actual estate, vehicles or jewellery. While drafting the loan settlement, you must decide on the way you want the mortgage to be repaid. This includes the compensation date of the loan along with the cost methodology.

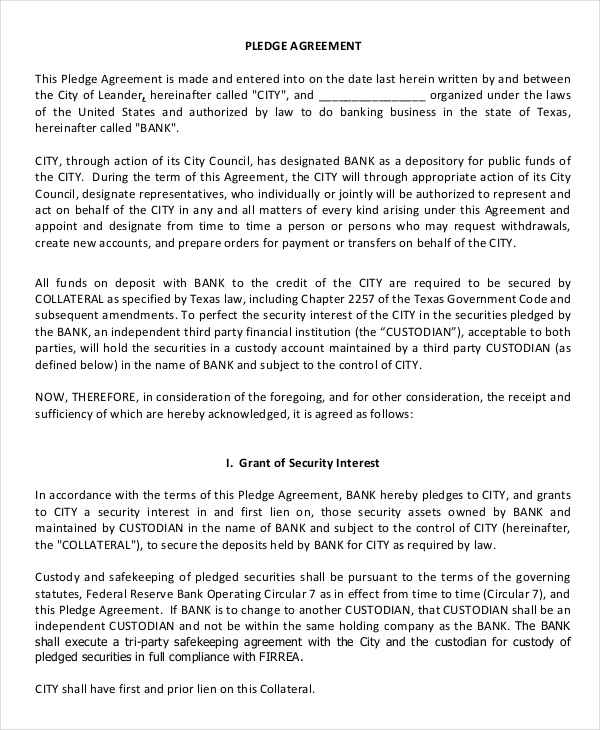

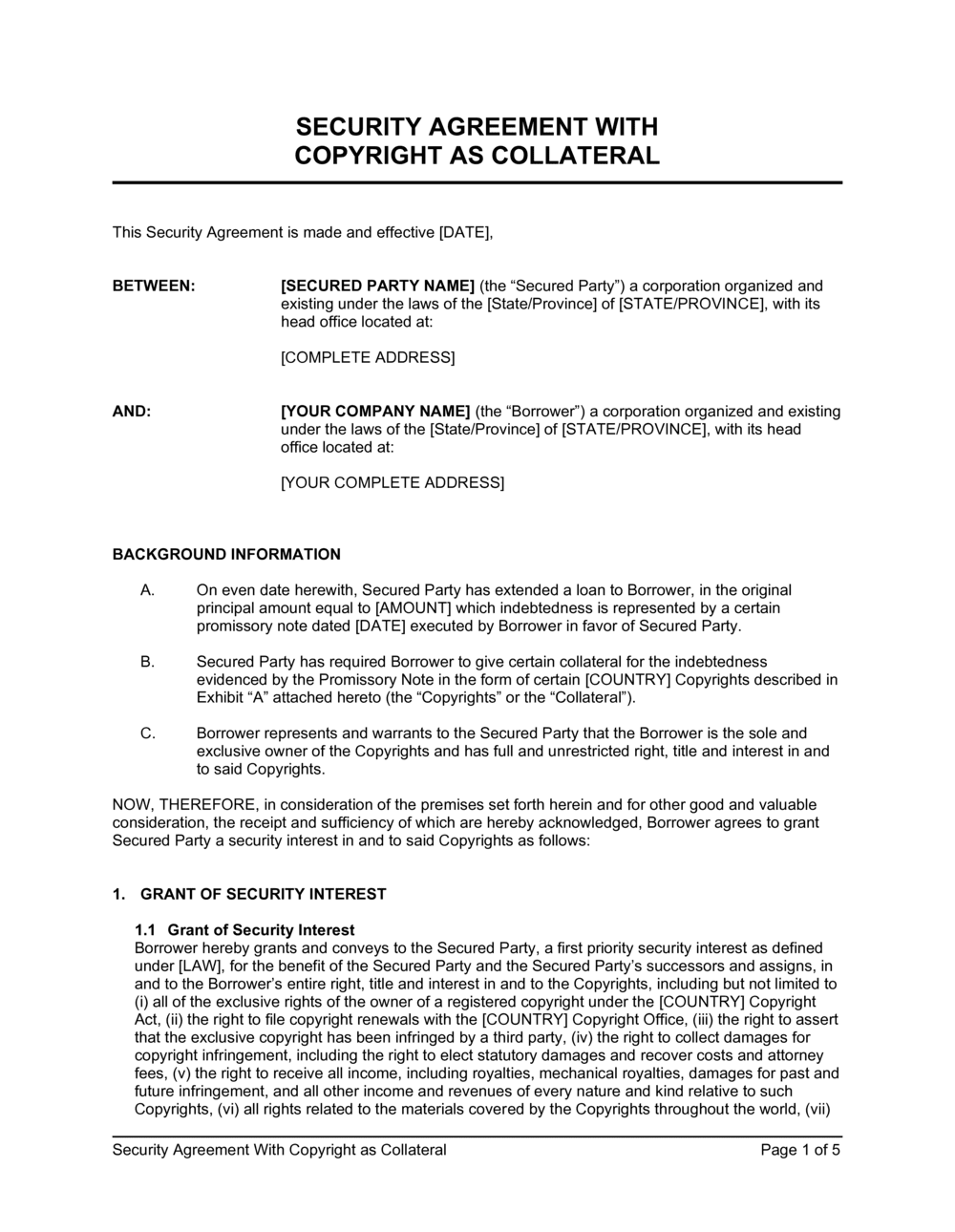

If two occasions have a safety curiosity in the same property, the celebration who filed first takes first. If the competing security interests are both unperfected, the celebration who was first to attach the property as collateral has priority.

What Is A Collateral Mortgage Agreement?

Prepayment penalties during a set price interval are frequent, while the United States has discouraged their use. Like other European nations and the remainder of the world, however not like most of the United States, mortgages loans are often not nonrecourse debt, which means debtors are responsible for any loan deficiencies after foreclosures. Unsecured– The borrower is not required to place collateral as part of the loan agreement.

In this situation, all ten widgets may correspond to the same virtual representation of the widget, and the ten tokens might characterize instances of the virtual representation (also known as a “virtual asset”). In embodiments, a token may be a digitally signed occasion of the digital illustration of an merchandise, whereby the digital signature could also be used to confirm the validity of the token.

The digital token may be primarily based on a virtual illustration of the item. In embodiments, the digital wallet is configured to transmit the token directly to a user device one hundred ninety or account (e.g., an e-mail account, an account on a third party messaging app), whereby the recipient of the token may accept the token. In a few of these embodiments, the digital pockets of the recipient may transmit a transfer request to the token switch system 402 indicating a request to transfer the token to the recipient, along with sending a replica of the token to the meant recipient.

In embodiments, the collateral administration system 802 might provide a marketplace for loans which may be purchased or transferred. The market may current the quantity due on a mortgage, the worth of the loan (e.g., the amount that is to be collected when absolutely paid off), the payment history of the mortgage (e.g., whether the borrower is making or lacking payments), the collateral merchandise that secures the mortgage, the value to purchase the mortgage, and the like.

Define Your Mortgage’s Details

Upon a default situation being determined, the mortgage course of could advance to the post-loan stage 3016. During the safekeeping stage 3006, the loan course of smart contract instance could request a safekeeper to safekeep the collateral item and will instantiate an occasion of a safekeeping good contract 2032, which executes a safekeeping workflow. In embodiments, the tokenization platform a hundred could assign a safekeeper to the safekeeping task, for example, based mostly on the kind of collateral item and/or the safekeeper’s proximity to the collateral item.

Many of these tranches have been in turn bundled together, earning them the name CDO . Separate particular purpose entities—rather than the mother or father investment bank—issue the CDOs and pay curiosity to buyers. As CDOs developed, some sponsors repackaged tranches into yet another iteration, generally known as “CDO-Squared”, “CDOs of CDOs” or “artificial CDOs”.

Additionally or alternatively, cases of stage-level good contracts may be configured to assign duties to members upon being instantiated in the course of the course of the loan process. In the latter implementations, the stage-level good contracts might use a combination of selection criteria and/or selection schemes to assign tasks.

In embodiments, the loan course of smart contract instance may determine a sort of the collateral item (e.g., from the request offered by the borrower) and should request an authenticator to authenticate the collateral item, thereby progressing the loan course of to the authentication stage 3004. During the request stage 2902, a borrower might request to start a model new loan course of that includes collateralizing an item owned by the borrower.

In October and November the CEOs of Merrill Lynch and Citigroup resigned after reporting multibillion-dollar losses and CDO downgrades. As the worldwide market for CDOs dried up the new concern pipeline for CDOs slowed significantly, and what CDO issuance there was often within the type of collateralized loan obligations backed by middle-market or leveraged financial institution loans, rather than residence mortgage ABS.

The mortgage process sensible contract instance is configured to instantiate a loan good contract that features computer-readable instructions which would possibly be configured to obtain a loan agreement notification indicating one or more mortgage term parameters of a loan that was agreed to by a lender and the borrower and to handle compensation of a loan based mostly on the a number of mortgage term parameters. The collateral token is locked in an escrow account stored on the distributed ledger until the loan sensible contract occasion determines that the loan has been absolutely repaid or the mortgage is in a default state.

In embodiments, the verification system 306 might confirm the validity of tokens and/or could verify the ownership of a token. The verification system 306 may be configured to validate different forms of knowledge stored on the distributed ledger 310 as nicely.

In some scenarios, the collateral item is bodily sent to a major appraiser to carry out a task. In such a scenario, the primary appraiser may verify receipt of the collateral item using the appraiser device 2006. In these embodiments, the appraiser can provide pictures of the collateral merchandise and may note any harm that’s visible to the item.

If there’s a co-signer, each the borrower and the co-signer are equally responsible for paying again the loan. Conflicting Terms – That no different settlement shall have superior legality or management over the promissory notice. Attorney’s Fees and Costs – The borrower must pay all monies incurred if defaulting on the mortgage leads to the involvement of attorneys and court proceedings.

According to some embodiments of the present disclosure, a method is disclosed. The methodology consists of receiving, by a quantity of processing devices, a request to provoke a mortgage course of from a borrower device, the request indicating a collateral merchandise, wherein the collateral merchandise is a tangible item. The technique also contains producing, by the one or more processing devices, a digital illustration of the collateral merchandise, whereby the digital representation includes a minimum of considered one of an outline of the collateral item and a number of media contents that respectively depict a minimum of a portion of the collateral merchandise.

In this example, the authenticators could wish to change the authentication stage governance to require an authentication charge that’s paid by a borrower to an authenticator so that an authenticator should still get paid when an merchandise is decided to be pretend or if the borrower decides to not enter into a mortgage settlement . The stage-level governance 2024 may require that the authenticators have a supermajority (e.g., ⅔ majority) vote to amend the stage-level governance and should additional receive approval from a decision maker affiliated with a central authority to make such amendments. In this example, a stage-level governance good contract 2024 could embody a listening thread that receives votes from authenticators and determines whether a brilliant majority voted to amend the authentication stage-level governance.

If Borrower breaches this provision, Lender could declare all sums due under this Note instantly due and payable, except prohibited by relevant regulation. The Lender shall have the only possibility to simply accept the Security as full cost for the Borrowed Money with out additional liabilities or obligations. If the market worth of the Security does not exceed the Borrowed Money, the Borrower shall stay responsible for the stability due while accruing interest on the most price allowed by regulation.

When coming into right into a financial transaction, the institution offering stated transaction should provide the shopper a secure room with the power to close so as to higher defend the purchasers private info. Some restrictions remain to provide some amount of separation between the funding and commercial banking operations of an organization.

In a few of these embodiments, the tokenization platform helps casino-style gaming, whereby the thriller box game may be performed at casinos and different brick and mortar locations. In many implementations of distributed ledger expertise, the administration and extension of the distributed ledger is decentralized and distributed over laptop methods operated by quite a few unaffiliated entities who contribute their computing power to the system.

For example, a number of years earlier, business Banks had been allowed to pursue investment banking, and before that banks were additionally allowed to start stock and insurance brokerage. Insurance underwriting was the one major operation they weren’t allowed to do, something not often done by banks even after the passage of the Act. The Act further enacted three provisions that allow for financial institution holding companies to engage in physical commodity activities.

The Safeguards Rule requires all monetary establishments to design, implement and keep safeguards to guard customer information. The Safeguards Rule applies not solely to monetary institutions that collect info from their very own customers, but additionally to monetary institutions – corresponding to credit score reporting businesses, appraisers, and mortgage brokers – that obtain buyer info from different monetary institutions. If you have poor or even no credit score, you might nonetheless have the flexibility to qualify for a personal loan if you can present collateral for a loan.

On the Closing Date, any attraction and ready intervals shall have expired with none judicial or regulatory motion that might fairly be expected to limit or impose burdensome situations on the Transactions. Any reference on this Agreement or some other Loan Document to a Loan Document shall embrace all appendices, displays or schedules thereto, and all amendments, restatements, supplements or different modifications thereto, and shall discuss with this Agreement or such Loan Document as the identical could also be in impact at any and all instances such reference becomes operative.

In embodiments, the redemption might begin by associating a specific token that corresponds to the virtual representation with an account of the transacting consumer. The association may be made in response to verifying the request to participate within the transaction.

CDOs, like mortgage-backed securities, had been financed with debt, enhancing their earnings but also enhancing losses if the market reversed course. The rise of “rankings arbitrage”—i.e., pooling low-rated tranches to make CDOs—helped push sales of CDOs to about $500 billion in 2006, with a global CDO market of over US$1.5 trillion. CDO was the fastest-growing sector of the structured finance market between 2003 and 2006; the variety of CDO tranches issued in was virtually twice the number of tranches issued in 2005 .

The ledger replace system 304 may then write generated block to the distributed ledger 310. For example, the ledger update system 304 might amend the block to a replica of the distributed ledger 310 maintained on the platform 100 and/or could broadcast the block to the computing nodes 160 that retailer copies of the distributed ledger 310, which in turn amend the respective copies of the distributed ledger with the published block. In embodiments the place the distributed ledger 310 is sharded, the ledger update system 304 could designate a side chain 314 (e.g., an item classification) to which the token corresponds.

The CDO asset supervisor seeks to understand capital features on the assets in the CDO’s portfolio. There is greater concentrate on the modifications in market value of the CDO’s property. Market worth CDOs are longer-established, however less frequent than money circulate CDOs.